What is 500FastCash?

500FastCash.com is an online lender which provides short-terms loans to people in the USA and Poland. They promise to provide customers with quick and easy application and approval process. 500FastCash transfers the funds typically within 24 hours. The company is owned by Red Cedar Services, Inc. Red Cedar Services, Inc. – a federally recognized Indian Tribe.

| Loan types | Min/max loan amount | Period | Daily PR | Documents | Poor credit history |

| Short-term loans online | Not specified | 30 days | Individual | ABA/Routing Number, Driver’s License, SSN | Unknown |

500FastCash.com Loans

500FastCash provides clients with emergency short-term loans when they need it most. It allows customers to borrow the funds they need and repay them back when they get paid. Clients simply need to complete a loan application online. Once approved, the money is transfered directly to the specified account the following business day. Though the money is usually transfered the next business day, it will be up to the customer’s bank to make the funds available to the particular customer. 500FastCash mentions that if the customer does not see the loaned money in his account the next business day after approval, he should contact his bank’s ACH (Automated Clearing House) department for detailed information. The lender specifies that an ACH is an electronic money transfer from one bank account to another.

Terms of Use

In order to apply for a 500 Fast Cash loan, you must correspond to the following criteria:

- Have a job or receive an equivalent regular income for at least 1 month;

- Make equivalent to at least $800 USD every month;

- Be at least 18 years old;

- Have a checking account.

The lender mentions that there may be other requirements during 500 Fast Cash loan application process. Besides, customers should pay attention that minimum income requirements vary by country.

The maximum and minimum loan amounts are not specified. The interest rate of a short-term loan depends on the loan amount and whether the customer has set up an Extended Repayment Plan or chosen a One Time Payment. The APR can be seen on the final page before the customer signs and is specified in the Federal Truth and Lending Disclosure during customer’s selection of the Repayment Plan.

500FastCash mentions that customers cannot reduce the charge on their initial short-term loan. The initial charge is fully earned at the time they receive their short-term loan. If clients later schedule an Extended Repayment Plan, they can opt to pay additional funds toward the principal balance, thus reducing periodic finance charges for further scheduled payments.

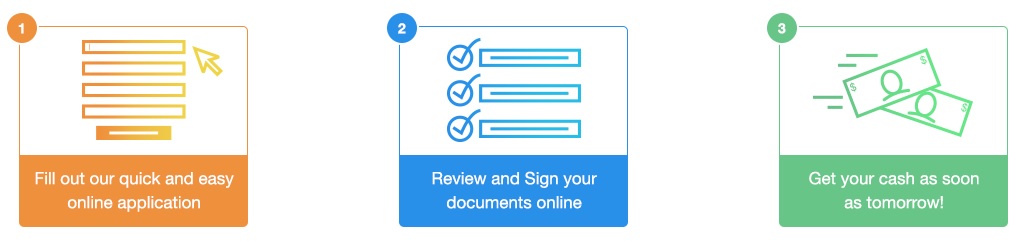

Application Process on 500FastCash.com

The service guarantees a safe, quick and convenient application. Customers will only need to follow 3 simple steps: Fill out an application form, review and sign the documents online, get money as soon as the following day:

Once the user has completed his online application he will have to accept the terms of his short-term 500 Fast Cash loan and electronically sign the Loan Agreement documents. These loan documents include the full terms of this particular short-term loan.

As soon as the customer completes a 500 Fast Cash loan application, it is sent to 500FastCash processing department for review. If the loan is approved by 2:30 pm and no additional information is needed, the lender will send the money to the user’s account the next business day.

Once the customer’s loan application is approved, 500FastCash sends an email to the email address provided within the application. This email will have the subject “Congratulations” and will include an estimated funding day and a summary of loan terms that the user agreed during the application process.

The lender may require some additional information prior to the approval of the customer’s application such as proof of income (for example, a copy of a recent bank statement confirming regular direct deposits of income, or an award letter for government benefits).

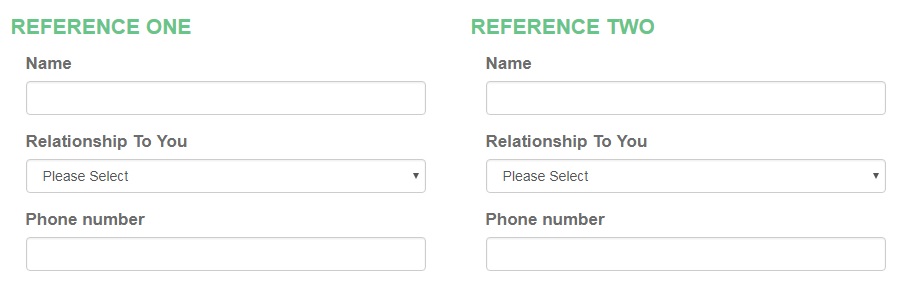

In addition, customers should be ready to provide 2 personal references (guarantors), personal information (including Driver’s License, SSN) Employment information, Banking information (ABA/Routing Number).

Once the client submits his application, 500FastCash will use certain guidelines based on the information the customer has provided to determine the loan amount he qualifies for. After successfully repaying the first short-term loan, 500FastCash can increase any future loan amounts.

Loan Repayment

The due repayment date is based on the customer’s next payday that he provided within his online application. 500FastCash currently accepts payments by debit card, personal check, money order. The company has a finance charge associated with the short-term loan. This information is included in the initial Loan Agreement documents and is based on the loan amount the customer qualifies for. After the client receives his funds and chooses to extend repayment over multiple due dates, he will see the applicable charge as he builds his Extended Repayment Plan. The client will be able to change and review his extended payment schedule to comfortably fit his budget.

With 500FastCash, customers have two repayment options:

- Pay the loan in full: The loan is due in full on the customer’s first due date. The full loan amount will be debited from the user’s bank account on this date unless he sets up an individual extended repayment schedule;

- Set up the individual Extended Repayment Schedule: if a customer can’t pay his loan in the full amount on his due date and needs more than one payment, he can choose this flexible payment option. The user can choose how he repays his loan to best fit his individual needs. Customers should know that by extending loan repayment over more than one payment, he will have to pay additional charges resulting in a higher final payback amount. The user will need to sign a new agreement with 500FastCash confirming his extended repayment schedule).

If a customer wants to repay his loan early after he sets up his extended repayment schedule, he can do it without penalty, save money by avoiding those additional finance charges.

The company recommends avoiding a late payment. If there is a late payment, a customer may accrue additional fees, and his account will be sent to 500FastCash collection department.

Loan Extension

If a borrower needs additional time to repay his 500FastCash short-term loan, he will have the option to log in to his personal account and create an Extended Repayment Schedule once the money is sent to his bank account. This option allows users to repay their short-term loans over several due dates if they choose not to pay a full amount on the first specified due date.

500FastCash.com Bad Credit History

It’s obvious that all 500FastCash.com loans are subject to a credit check. The company looks at each application based on a user’s recent circumstances. However, it’s not mentioned anywhere on the website whether users with a bad credit history can get a loan with 500FastCash. We suspect that if a client has a very poor credit history, his application will be denied. But each case is individual and you still have a chance to be approved.

Technical Characteristics of the Website

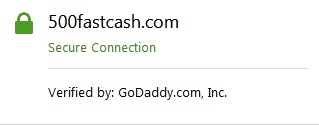

Is 500FastCash.com Safe in Terms of Connection?

500FastCash guarantees that all transactions are 100% safe and users’ personal information is protected. It turned out that the website uses a 256-bit Secure Sockets Layer (SSL) software, which encrypts the users’ information properly. This security level is good enough but still cannot be considered the best one. The upper left corner of the browser displays a green lock which means that 500FastCash.com is a safe place for online transactions. Regretfully, the owner of the website is not specified. The security certificate is verified by GoDaddy.com, Inc:

500FastCash.com Mobile Version

We checked the mobile version of 500FastCash.com with the help of Google Search Console. The service determined that the website is “mobile-friendly”, which can be seen on the screen below:

All page resources are loaded successfully, so users will not have any problems when visiting the website from a mobile phone. In general, the mobile pages have the same functionality, the text is readable, the menu is convenient. It seems that the website’s mobile version has no drawbacks. The mobile website functions properly in all respects.

Checking Antivirus

Unfortunately, the owner of 500FastCash.com provided no antivirus on the website, which indicates that users can infect their computers with malware or viruses. This is a serious drawback since large and trusted online websites use antivirus programs. The lender needs to fix this drawback to deserve a better rating. So far, this website can’t be considered 100% safe.

The Convenience of Using 500FastCash.com

The point which makes this service convenient is that customers do not need to register to start an application process. However, the lender recommends creating a personal account which would save the customer’s personal information (it’s especially convenient if a user plans to use 500FastCash services for more than once):

As we have already mentioned before, the online form is purely online, there is no need to fax documents, however, the user must provide a detailed personal and employment information and 2 personal references, which would confuse some customers since many online lenders do not require any guarantor.

We are disappointed that the lender did not provide the information on the exact 500 Fast Cash loan amount available. Besides, we found no representative examples on the website which could have been very helpful for customers to better understand how this company works.

The website has no loan calculator which would have allowed borrowers to get a better understanding of 500FastCash’s terms and rates.

However, the website has a FAQs section and customers can find the necessary information in the shortest term:

The website can be considered informative since it lacks some important information on loan details and examples. The online application form is easy to fill, but other online services require much less information.

Is 500FastCash.com Legit?

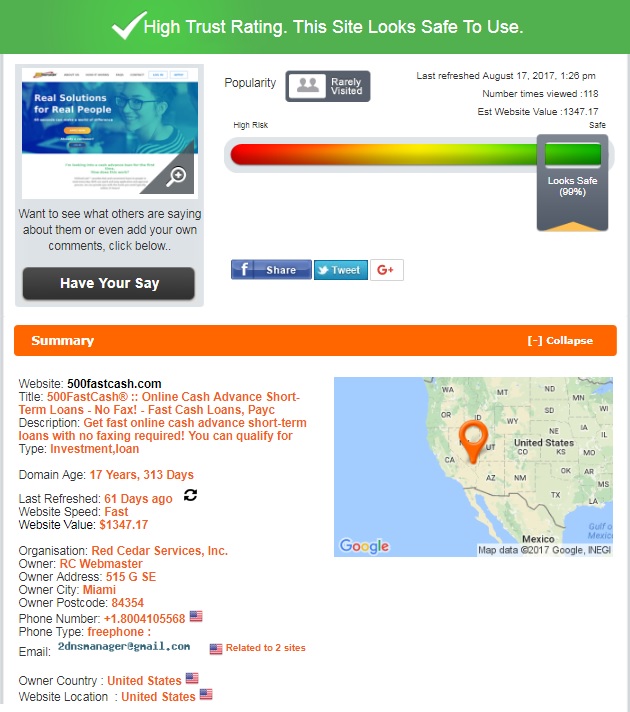

Before using 500FastCash.com, we need to ensure that this website is legit and can be trusted. We checked its credibility using Scam Adviser online service and were happy to find out the website has a 99% trust-rating out of 100:

According to Scam Adviser, this website is located and owned by the USA. The domain age is almost 18 years, which is a very good sign and a decent period for a website providing online loans. However, the website has a few visitors and uses free contact email, which was probably the reason for taking one percent off the website’s rating. Scam Adviser mentions that using free contact email is not necessarily worrying, depending on the website. But for online shops, this could be a sign that the website has some risk. In general, we were satisfied with the information we discovered about 500FastCash with the help of Scam Adviser.

500FastCash.com Reviews

On-site 500 Fast Cash reviews

Regretfully, there are no 500 Fast Cash reviews on the website itself. The website has no separate section where customers could share their personal experience with this lending service. It’s a drawback, because all customers want to know what other users say about this company. In our opinion, customer reviews is an important part of any online service, since it’s the only reliable way of checking the company’s reputation. So, we did not manage to assess the credibility of 500FastCash.com basing on user on-site reviews, so we had to search for any reviews on third-party websites.

500FastCash.com Reviews on Other Websites

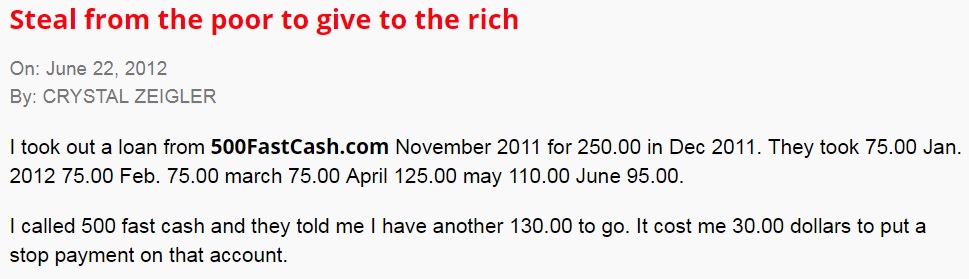

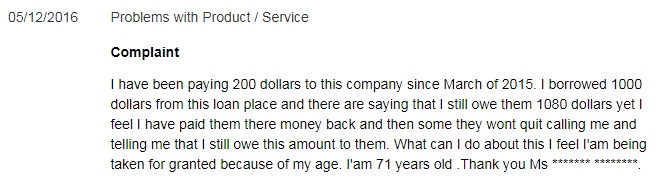

We found a good number of 500FastCash complaints on several independent websites and NOT a single positive review about this company.

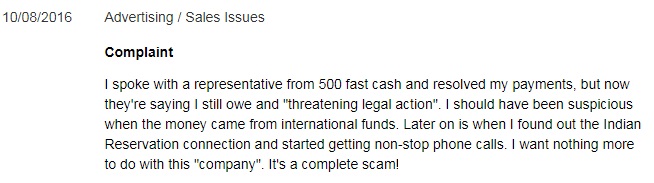

Many complaints are dated 2012 and 2013. There are several 2016 complaints. Customers rated the lender 1 or 2 stars and complained of problems with loan repayment. All reviews seem to be written by real customers. According to user reviews, 500FastCash said that they still owed them after they repaid loan amounts in full:

Regretfully, 500 Fast Cash reviews on BBB also showed the online lender in a bad light: the website contained 8 complaints. Users faced the same problem with loan repayment and said this company was a total scam:

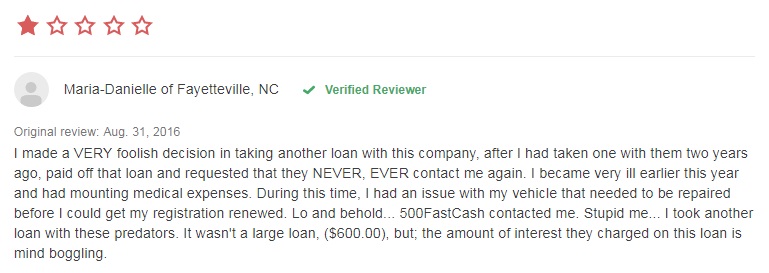

One more customer says it was a foolish decision to take a loan with 500FastCash. It was not a large loan, but she had to repay an enormous total amount in the end:

The lender has no reviews 2017 and it seems very strange that the company has not received any positive reviews over 17 years of operating.

Contact Us section

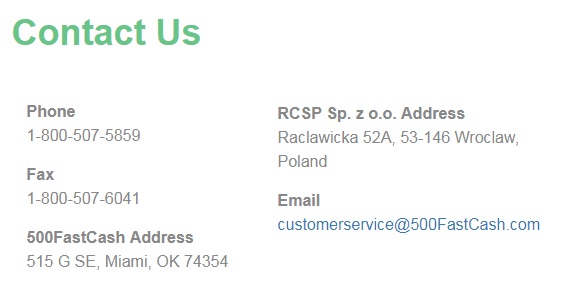

Contact Information

The online lender provided the following contact information on the website: 500 Fast Cash phone number, fax number, email, two physical 500 Fast Cash addresses (Poland and the USA), which proves the transparency of the company.

The provided information is detailed and we found nothing that could shake the confidence of the customers.

500FastCash Locations

500FastCash is available in Poland and all US states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming.

A broad availability across the USA is a big advantage, however, customers should bear in mind that each state has its own APR.

Customer Support Service

Unfortunately, 500FastCash.com has no Live Chat where customers could have got the necessary information immediately. If customers have any questions, they can send an email at [email protected] or call at 1-800-507-5859. The company guarantees that the customer service representative will answer a question in the shortest possible time. Customers can also reach the lender by filling in the contact form:

Since we were interested in one aspect, we decided to reach the manager through the contact form. We wanted to find out the minimal loan amount this service could provide. It does not seem that the customer support service is “available 24 hours a day 365 days a year”, as we waited for more than 4 hours and did not get any reply. 500FastCash customer support service needs to introduce an instant messaging, otherwise, customers will find another online service for getting loans online.

Conclusion

There is not much to say about 500FastCash.com, besides that they transfer funds quickly and have an extended repayment plan. Regretfully, they provide no information on loan details. There is too little information available on the website. We found no information about APR rates, loan minimums and maximums, fees and penalties for missed or late payment. In the FAQ section, it is mentioned that a customer will be charged a fee if a payment is late. So you do not know the amount of debt, fees, payment schedule and interest rates before signing up with this lender. The website also does not provide information about online application processing times. They say that repayment is due on your next payday but there is no specific term, such as a 20- or 30-day loan period. Transparency is very important as it allows customers to do proper research before choosing the online lender. In addition, this lender does not approve loans to service members or dependents, so if you a service member or a dependent, you won’t be able to get a loan from 500FastCash. Negative reviews about the company are also frustrating. We recommended staying away from this online service. We found no relevant reason to work with them. You’d better check out some higher trusted companies that have a better reputation.

Ready to Apply?

Ready to Apply?