What is CashMax Texas?

CashMax Texas is an online lender providing loans all across Texas. The company claims that convenience and privacy which come with their financial products is the reason why many people are choosing this lender when having the need to find cash quickly.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans, title loans | $100 | $15,000 | 14 days – 168 days | from 400% to 712% | SSN, Driver’s License number, proof of income | Unknown |

Types of Loans

CashMax Texas offers payday loans and title loans online.

- Payday loans are small amounts of money that are expected to be repaid on the day you get paid. This means that a customer must be employed to qualify for this type of loans. The lender promises to process a payday loan request quickly, so a borrower will be able to get the cash he needs for any situation. Such loans are often taken to repay a car, pay for bills and medical expenses. So when you need fast money before your next payday, this lender will help;

- Title loans are types of loans in which you use your car as collateral. However, you can continue using your vehicle. You only need to come to the lender’s location, get cash and drive off in your car.

Regretfully, the company did not mention how quickly customers can get payday loans. Obviously, just like other lenders, CashMax either deposits the funds in one business day to your checking account if you apply online or gives the cash in hand if you visit one of the in-store locations, but this aspect is to be specified.

Terms of Use

CashMax offers loan amounts ranging from $100 up to $15,000. Their loans subject to lender approval. They mention that not all clients will qualify for a maximum loan amount. The decision will be based on a borrower’s credit score, income, and some other factors.

Lending periods may range from 14 days up to 168 days. Loan terms may also vary by location.

The company has standard eligibility criteria: you need to be a least 18 years old, have a steady and reliable income for at least 3 months, have an active checking account in your name, and be a resident of Texas. In some cases, the lender may approve a loan request even if a client does not have a regular paycheck. For example, you may be a property manager and receive regular rent checks from your tenants. In this case, this means you have a steady income and can be approved for a loan. However,m you need to prove to CashMax that you receive regular earnings.

If you are planning to get a title loan, you will need to own a car to use it as collateral to pay for the debt in case you fail to repay your loan.

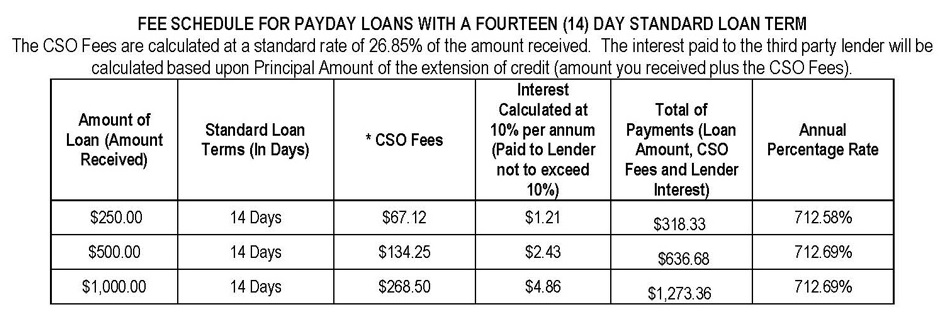

The lender mentions that their APR may range from 400% to 712% based on the loan type and term. The website has many representative examples illustrating fee schedules for a payday loan and title loans with various loan terms:

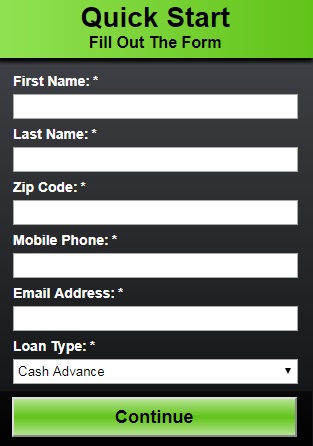

Application

At CashMaxTexas.com, you can apply for a payday or title loan online. The company has a quick and simple application which only 5 few minutes to complete.

You do not need a provide a collateral for payday loans, while title loans will require that you have a car to use as collateral.

During application, you will be asked to fill in your name, address, email, phone numbers, Social Security number, employment information, a source of income and its size, account balances, your payment history and previous transactions, driver’s license number, and some more details.

When applying for a payday loan, you may either get the funds online or visit one of the CashMax locations in Texas. With title loans, you will need to come to the office so that the lender could assess your car value.

The lender typically does not request customers to fax any documents, however, in some cases, you may be asked to provide an additional verification of your identity or income.

Loan Repayment

CashMax offers 30 / 14 / 150 / 168-day loans that are to be repaid either bi-weekly or monthly. They provide the detailed information on the different fee schedules.

If you fail to repay your title loan, the lender will possess your car used as collateral.

If you are not able to repay your payday loan, you will be charged a $30 penalty fee, If you are 10 days late with making a payment, you will be charged 5% of delinquent payment or $7.5, whichever is greater.

The lender also has a right to use the services of independent collection agencies to collect the existing debt. In any case, any measures taken will be legal and compliant with Texas law.

Loan Extension

Regretfully, the website does not contain any information about loan renewals. This may mean that CashMax Texas does not offer extensions in case a client has difficulty repaying his loan on the due date. You’d better call the lender’s directly and specify this information before you decide to apply for a loan.

The information about how many CashMax loans you can have at a time is not presented either.

CashMaxTexas.com Bad Credit

The company does not advertise approving loan even to borrowers with a bad credit or no credit at all. I guess they may approve a loan if you had a poor credit history but your interest rate will depend on your credit history: the lower credit score you have, the higher interest rate you’ll have.

The lender recommends you to learn your credit history before taking a loan through this website. They also mention that missing payments can damage your credit rating while making payments on time can improve it.

Technical Characteristics of the Website

Encryption

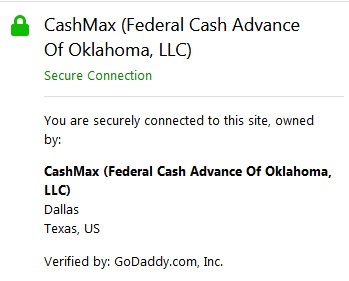

The company claims that they respect their customers’ right to privacy. They say every transaction made at CashMaxTexas.com is 100% confidential. The lender uses security measures that comply with Texas law that protect users’ personal information from unauthorized access of third parties. These measures include using a 128-bit Secure Socket Layer. The URL “https//» means that the website can guarantee the security of users’ sensitive data. The secure connection is verified by GoDaddy.com, Inc.:

It was also nice to see that the website is using an extended verification certificate: the top left corner of the browser shows a name of the website’s owner: CashMax (Federal Cash Advance of Oklahome, LLC). In general, the encryption level is satisfying, however, a 128-bit secure socket layer is not the most advanced security measure.

Mobile Version

CashMax page has been redesigned for a mobile device. In general, all content (information and answers to frequently asked questions) are present on the mobile version. However, the wording, formatting and output of data do not coincide with the full-size version of the site. The product page looks different. The help section contains all the necessary information on both versions of the site, but the formatting of the pages differs.

Using the mobile version, you can easily scroll the page with one finger. The text and images are enlarged. All these modifications simplify the work with CashMax mobile version.

Antivirus

CashMaxTexas.com maintains procedural safeguard using McAfee virus protection software, which reduces the risks of getting infected with viruses and malware programs to the minimum. McAfee prevents your sensitive personal information from being stolen.

It’s nice to know that this website is not trying to steal clients’ personal information or infect their computers.

Convenience of Using CashMaxTexas.com

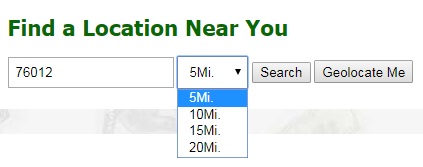

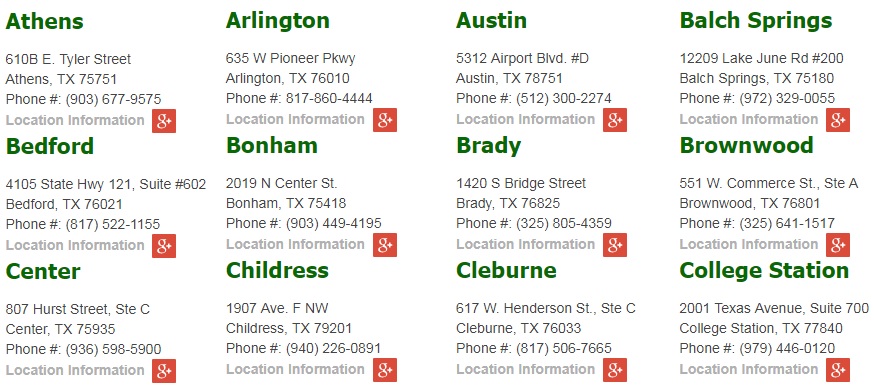

Using this lender, you can apply for a loan online, at one of their in-store locations across Texas, and even get pre-approved over the phone. The website has a special «Locations» section to find the nearest CashMax location in your city.

Another advantage is that a user is not required to register on this website prior to applying, which saves much time. You can fill out a Quick Start form located on the main page of the site:

Most CashMax loans can be completed in only 15 minutes. I also like that all of their terms and rates are specified on the website and you can see them before filling out an application.

In general, a loan request form looks simple and convenient and requires clients to provide only standard personal and financial information.

New borrowers can find answers to frequently asked questions in an FAQ section.

I think you will not have any difficulty applying for a payday or title loan through this website.

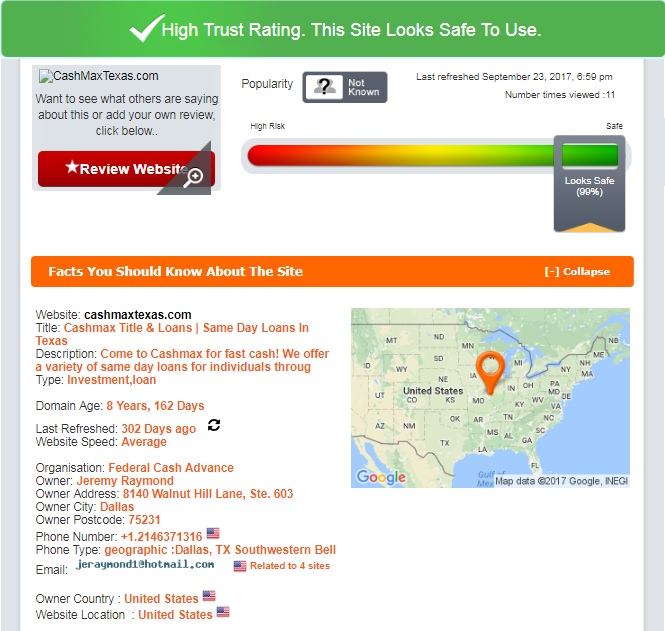

Is CashMaxTexas.com Legit?

CashMax trust rating from ScamAdviser looks impressive – the lender has received 99% out of 100%, which means that this website is legit and can be trusted.

According to ScamAdviser, the domain has been active for over 8 years. The website is located in the United States and owned by Jeremy Raymond from Federal Cash Advance, Dallas. However, ScamAdviser was not able to determine the site’s popularity. This explains why CashMax received 99% of trust out of 100%.

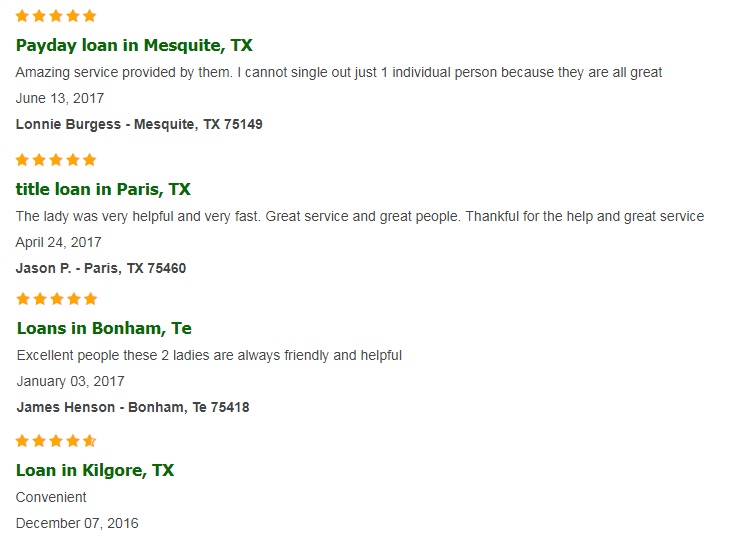

CashMaxTexas.com Reviews

On-site Reviews

Fortunately, the website has a Testimonials page with 86 customer reviews. The average rating for CashMax Texas loans is 5 stars. Actually, I was not able to find a single 4-star review. It seems that all of the clients were fully satisfied with payday and title loans provided by this company.

The recent CashMax review was posted in 2017 by Idae A. from Dallas who was able to get a personal loan. He reported that the service was amazing and all the employees were great.

Tiffany M from Killeen took a loan on September 22, 2016, and reported that the lender was awesome and helpful. She added that if she ever needs a loan again, she will surely use this company again.

Oscar from Grandview was able to get a cash loan on August 11, 2016. He said CashMax staff was very helpful and sweet and he would recommend this lender to everyone.

Michael F from Austin was approved for a payday loan on April 17, 2016. He stated that this company was a consummate professional. He added that effective people like CashMax employees are rare in any profession.

Marla Kay Williama from Paris (Texas) posted a CashMaxTexas.com review on March 30, 2016. She had never had a pleasant experience with any online lender until she visited the office of CashMax. She said their manager was not only helpful and pleasant but she treated her with respect and dignity. This was the first time she had such a wonderful experience with a personal loan. She would never deal with other lenders again. She added that at this company, she was treated as a real person.

It’s nice to see that this lender has a good online reputation but I also decided to search for some CashMax Texas reviews on independent websites.

Reviews on Other Websites

Unfortunately, I did not find any CashMax reviews from customers on independent third-party websites. All I was able to find are comments from previous employees of this company. All of them reported that it was nice to work at this company and it was a good business on the Internet. These reviews evidence that this business really exists but does not prove that it is able to satisfy all customers. If you ever use CashMax services, let us know! It looks a bit suspicious that this lender does not have any reviews on third-party online sources.

Customer Support

Contact Information

The website has a comprehensive contact information for every CashMax in-store location: physical address (with a map), email address and phone number. You can see these details on the “Locations” page. You can visit the same page to find the nearest in-store location in your neighborhood:

CashMaxTexas.com Locations

CashMax has over 40 locations to serve clients all across the state of Texas. Regretfully, residents of other states will not be able to get a payday or title loan via this company.

Visit the “Locations” page to see the list of CashMax in-store locations in Texas.

Getting a Consultation

If you have a question about CashMax various lending services, you can contact their customer support over the phone (which is unique for each location) or visit one of their store locations in Texas where their representative will answer all of your questions and help you get the necessary funds today.

I tried to contact the customer support via email given for their Brownwood location to find out whether CashMax Texas offered loan extensions. Unfortunately, the answer never came. This means that their customer support is not working as effectively as you may expect.

Conclusion

CashMaxTexas.com is a lender providing payday and title loans who have weighty advantages: a high trust-rating from ScamAdviser, high loan amounts up to $15,000, 100% disclosed rates that are competitive, a simple online application, less paperwork, a quick lending decision, good customer reviews on the official CashMax website. But I still have some doubts about this lender since I found no reviews on independent third-party websites. Besides, some aspects remained unclear, namely loan extensions and the chances of borrowers with a bad credit. I give this website the rating of 3.8 stars out of 5 and recommend you to look for another lender who has a well-established reputation on the web.

Ready to Apply?

Ready to Apply?