What is Advance Financial 24/7?

Advance Financial 24/7 is a nationally recognized financial organization that provides flex loans, wire transfer, bill payment, and unlimited free money orders from 92 locations across the US. You can apply for a loan at a storefront and online. The company was founded in 1996 by a family in Nashville, Tennessee. The organization employs over 1,000 local representatives and has 24/7 operating hours, quick service and skilled staff. They strive to establish long-lasting and strong relationships with every client. The lender is proud to have a perfect online reputation and was named a Top Work Place byThe Tennessean.

| Loan types | Min.amount | Max.amount | Period | APR | Items required | Bad credit |

| Flex loans | $25 | $4,000 | Flexible | 240% -360% |

| Unknown |

Advance Financial loans

The company offers flex loans that are an alternative to payday loans, installment loans, and title loans.

A flex loan comes with an open-end revolving credit schedule. Customers take such loans to pay for household purposes, care repair, education, and so on. Such a credit option may be unsecured or secured by the property, without a limited length of term, can be repaid in whole or by installments at any time without fees. The lender mentions that flex loans should only be used to cope with short-term financial needs.

Unlike a regular payday loan or an installment loan, you can apply for a flex loan and get the cash at any time. People prefer such loans because of convenient flexible repayment. The lender offers flex loans online and at any one its locations in Tennessee.

So, such loans are as flexible as a client needs them to be.

According to the website, the funds will be deposited into your bank account within 24 hours.

Terms of Use

To get a flex loan, you need to provide a photo ID, have a verifiable source of income, and an open bank account.

Using this website, you can get flex loans in the amounts ranging from $25 up to $4,000. The amount approved will depend on your ability to pay off a debt.

The lender mentions that a flex loan is an expensive form of credit and recommends clients only borrow what they can afford to return. There is no grace period. A borrower will be charged interest every day he keeps the borrowed money. Af247 recommends users to repay more than the minimum amount due every time. If you make the minimum payment, you will be charged more interest and fees.

The APR varies by state but you should expect it to be between 240% and %360.

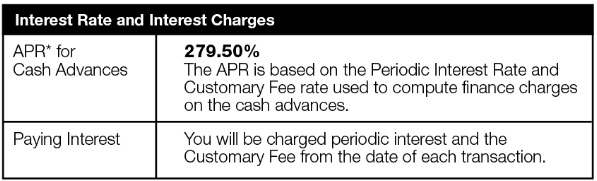

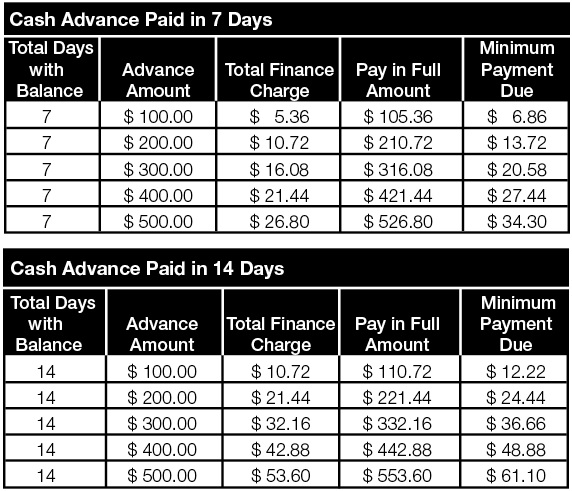

Advance Financial specified rates and terms for each state in which flex loans are available. You can find them in the Rates and Terms section. Here is an example of the APR for residents of Tennessee:

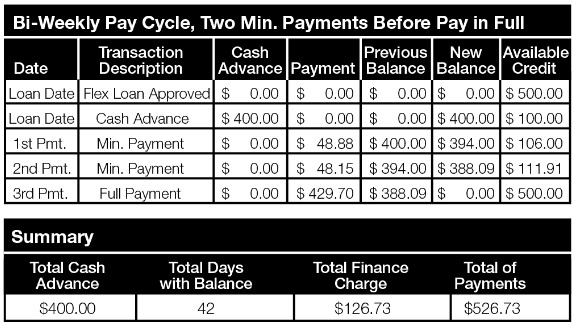

The company also gives examples for minimum and maximum payments depending on the loan amount and term. Here is an example of 7-day and 14-day loan payment schedule for borrowers from Tennessee:

The rates and terms look acceptable. Many other online lenders have higher interest rates that may even reach 1000% and more.

Application

Residents of 11 states can apply for flex loans and get the cash online without leaving the home. Customers living in Tennessee can also get the funds in one of the in-store Advance Financial locations across the state. The online application process takes about 5 minutes and is advertised as “paperless”:

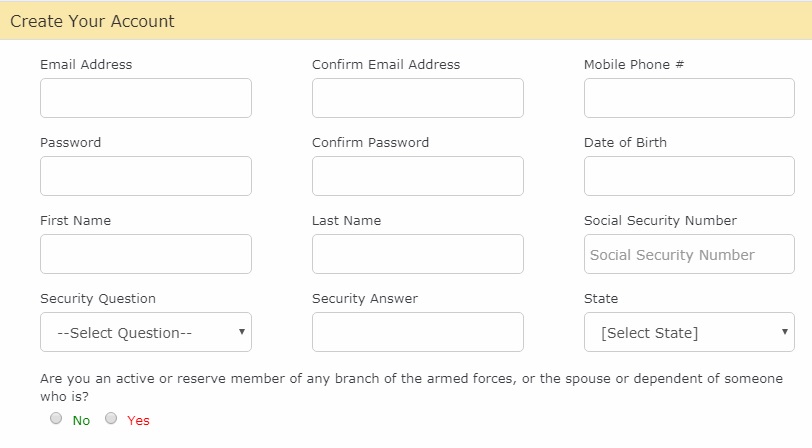

When you apply for a flex loan, the lender may ask for your full name, physical address, date of birth, employment information, state-issued photo ID (driver’s license, passport, and so on), SSN, TIN, or alien identification number, transaction details, and in some cases other documents that allow verifying your identity.

Unlike banks that don’t lend funds without collateral, Af247 is able to provide you a flex loan without collateral, which is very convenient.

Repayment

With flex loans, you can pay for your flex loan at any time. The advantage of this lender is that Af247 only pays interest and fees for the period you keep the borrowed funds.

Such loans are completely flexible. You can make the minimum payment on your payday or you can return the full amount anytime you want.

With a flex loan, the lender will keep a line of credit open so a borrower can withdraw more cash at any time.

The company usually aligns loan due dates with the customers’ paydays. When it’s due date, you can either pay the minimum amount on your loan or pay an additional amount so you can cancel the balance faster.

The example below shows flex loan repayment plan with two minimum payments before paying in full (for residents of Tennessee):

A good thing is that the lender does not charge an annual fee, late fee, or penalty fee:

In case of non-payment, Advanced Financial 24/7 can initiate collections via mail, phone, text message or email.

Loan Extension

As you repay your balance, you will be allowed to take out additional funds up to your credit limit. A flex loan allows controlling your loan completely.

Af247.com Bad Credit

There is no information about whether Advanced Financial checks your credit score before approving a flex. For details, you need to contact the lender.

Technical Characteristics

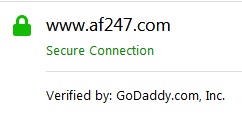

Secure Сonnection

Af247.com protects users’ personal information they submit to the website via a 128-bit SSL encryption protocol. They guarantee that your sensitive details will not get into the hands of third parties. A green lock symbol in the address bar indicates that the website is secured. The secure connection is verified by GoDaddy.com, Inc:

In general, a 128-bit encryption may protect users’ sensitive details to some extent but large and reliable web resources use a 256-bit that are able to provide a higher safety level.

Mobile Version

Today, almost every person has a mobile phone and sometimes a tablet device that he uses constantly. Modern devices, in addition to their direct purpose of making a call, can also be used to send e-mails, as well as to quickly apply for a loan online.

Af247.com mobile version is optimal for both regular customers and customers who make a one-time transaction.

The content is concise but at the same time includes all the basic elements. There is no distracting information so the customer can easily apply for a loan using a mobile device. Images are also small for fast loading.

A distinctive feature of af247.com mobile version is a high degree of usability, i.e. ease of use, which, without doubt, will best affect the position in the search, as well as the high traffic and the success of the web resource. The mobile version is equipped with convenient navigation using buttons, icons, etc. There are no text links. Large buttons are the most convenient tool for navigating the mobile version of the website.

Antivirus

Websites like af247.com must be secured with modern antivirus programs in order to provide a high security level for their users. Regretfully, this website does not have an antivirus, which increases the risks of being infected with viruses, worms, malware, and other online threats. Lack of antivirus undermined my trust in this online company. I recommend the website’s administrator to fix this problem.

The Convenience of Using af247.com

Before applying for a loan, you need to register on the website:

The whole process consists of 4 steps:

- Step 1: verify your email address;

- Step 2: invent password and log in into your personal account ;

- Step 3: fill in an online application, attach the necessary documents and submit your loan request;

- Step 4: sign a loan contract and get your money.

The lender asks you to provide only basic personal details in the application.

Advance Financial 24/7 claims that it’s easy to get a flex loan using this website. It’s nice that they have a page where you can find the nearest location of this lending company.

In general, the application is easy and intuitive. However, bear in mind that registration is compulsory and you should be ready to spend extra time creating a personal account.

Is af247.com Legit?

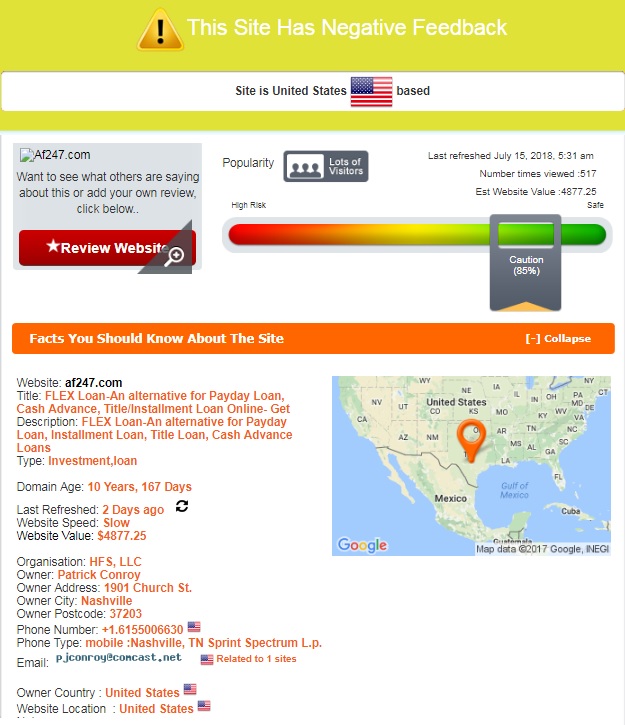

I decided to check whether this website is legit because they ask customers to provide their very sensitive details. ScamAdviser.com gave Advanced Financial only 85% out of 100% because this website has negative feedback:

ScamAdvser also detected the website’s owner – Patrick Conroy from HFS, LLC Nashville, Tennessee. It’s nice that the lender has nothing to hide. The domain age is also impressive – over 10 years. This means that af247 is an experienced lender. The sire has lots of visitors and seems popular.

Since this website has had negative reviews detected, you should check their online reputation before applying for a flex loan.

Af247.com Reviews

On-site Testimonials

Regretfully, the native website of Advance Financial does not have a testimonial page where the previous borrowers can share their experience with using Af247.com services. However, the company claims that 98% of their clients give them a 4+ star rating and encourages users to read customer reviews on trustpilot.com.

I will describe my research in the next unit of my review.

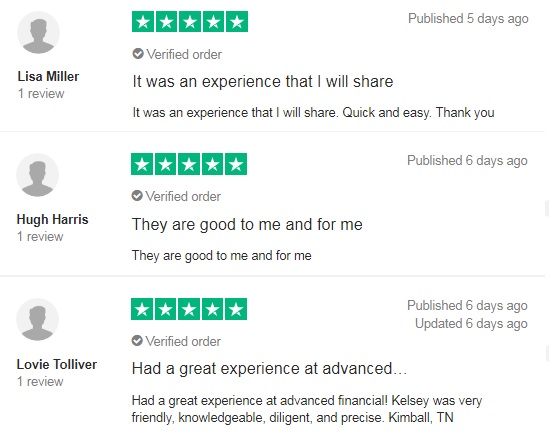

Af247 Reviews on Independent Websites

I found a huge number of positive Advance Financial reviews (including those from 2018) on independent third-party websites (TrustPilot.com and others). The recept reviewer reported that this company was very helpful. He applied for a 2-week flex loan and it was fine. The lender set up an individual loan repayment schedule and he had no prepayment penalty for repaying his debt before the due date.

Other customers mentioned that Af247 provided the best online loans ever and had a quick and easy application. Customer support was also appreciated by customers.

The below example shows what people think about this lender:

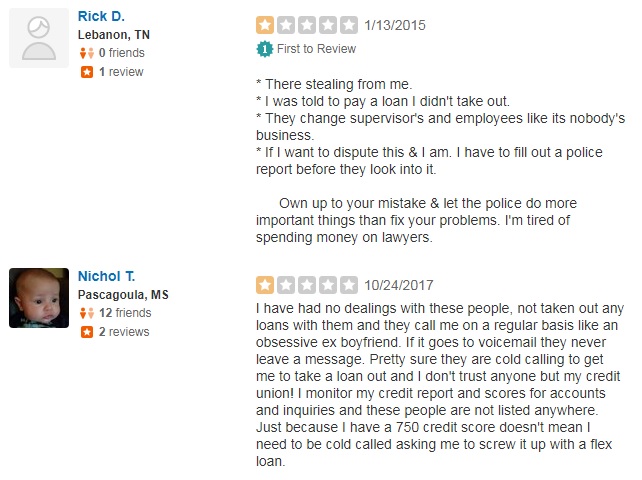

Regretfully, the amount of Af247 complaints was also huge. One client from 2015 mentioned that the lender was stealing money from him and told to pay a loan he did not take. He even had to fill out a police report. Another user had a similar issue – he never took a flex loan from this lender but the latter called him on a regular basis like an “obsessive ex-boyfriend”:

Too many clients were dissatisfied with the customer care department. One user reported that customer support was never able to resolve issues and concerns. An online chat was non-existent. He spent 2 weeks uploading docs. One day he had an emergency and wasted much time trying to reach the company’s representative. He added that it did not seem that Af247 had 24/7 service.

Another client needed only $500 for a couple of days and it was an awful experience. He would never do business with Advance Financial 24/7 again because he wasted a whole morning trying to contact the customer support.

The same complaint was posted by the next user who had spent 6 hours getting $450. He mentioned that the customer support could have been a little faster.

One more client was still waiting for a response from the lender after uploading all the necessary documents. He talked to 7 different employees but the issue was still unresolved. He just hoped he would get an answer before the company says his documents are expired. He added that their promise of a 24/7 business was a trick intended to attract attention.

So, Advance Financial has a mixture of numerous good and negative online reviews. This proves that the lender is very popular and experienced but a huge number of complaints from different periods related to customer support and annoying calls made me a bit concerned.

Customer Support

Contact Information

Af247 has in-store locations all across Tennessee so you can find the address and phone number for each of the offices. Their basic phone number is (615) 341-5900 and legal address is 100 Oceanside Drive, Nashville, TN 37204. They also have an email [email protected].

I was able to find all the contact information which is relevant for every customer. The lender seems to be transparent.

Advanced Financial Locations

Online flex loans are available in 11 states: Alabama, California, Delaware, Idaho, Kansas, Missouri, North Dakota, Tennessee, Utah, Virginia, and Wisconsin.

In-store services of Af247 are only available to customers living in Tennessee. The website has a map where you can check all in-store locations of the lender:

Getting a Consultation

If you have any concerns of questionsб you can reach Advanced Financial representative by calling (615) 341-5900 or sending an email using the form on the Contact Us page. If you have a question regarding your existing flex loan, you need to contact the location associated with your personal account. Unfortunately, a live chat option was unavailable.

I had a general question regarding the possibility of being approved for a flex loan with a bad credit. I decided to contact the company’s representative by using a contact form. I waited for 7 hours and finally they replied that unfortunately they “were not able to verify my identity” but why would they need it? I was just a general question about their services. I conclude that their customer support required further optimization.

Conclusion

Af247.com is a popular lender who has been providing flex loans for over 10 years. The company has many advantages: a high trust-rating from ScamAdviser, numerous locations across Tennessee, a huge number of reviews. They also have high maximum loan amounts of up to $4,000. Another advantage is that a client does not need to borrow the entire amount. Instead, he only borrows the amount he needs and the rest stays in his line of credit available to him whenever he needs it. As such, he only pays interest on the amount he borrows, not the entire line of credit. Besides, flex loans come with a flexible and individual repayment schedule. Rates and terms also seem acceptable. The main disadvantage is that online flex loans are only available to residents of Tennessee. Another thing that concerns me is that Advance Financial has received too many complaints regarding poor customer support and calling people who have never taken flex loans with this company. You may try to get a loan through this website but ONLY when you have no more options left. I would recommend you to search for a lender with a better reputation.

Ready to Apply?

Ready to Apply?