What is Bolt Payday?

Bolt Payday is a loan connecting service which matches customers with participating lenders in Canada and the United States. The company has no official government affiliation but complies with the laws of both countries. Since 2015, the service has been helping people to cope with financial emergencies, such as unexpected car repair or paying bills.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans | $100 | $2,000 | Varies | Ranges from 200% to 400% | Driver’s license/state ID, Social Security Number | Unknown |

Types of Loans

Bolt Payday offers payday loans online. These are small loans that give consumers free breath until the next day they get paid. Payday loans are often used for unexpected car repair or home improvement, a large purchase, paying for medical and utility bills. Some people even borrow funds to buy everyday essentials, such as food.

According to the website, it takes only 3 minutes to complete an online application form and up to 24 hours to get your cash transferred to your banking account. Bear in mind that cash transfer times vary between lenders.

Terms of Use

Using this website, you can borrow between $100 and $2,000. The Annual Percentage Rate ranges from 200% to 400%. The cost of a loan also varies and may be between 18% – 21%.

Bolt Payday cannot control and is not responsible for the actions of any lender. This online service is only a link between a borrower and a lender and does not have access to the exact rates and terms of your loan. All the loan details will be provided by your lender directly. Bear in mind that your personal information submitted by you on this site will be shared with lenders. You are not obligated to accept a loan offer from a participating lender and can decline it at any stage before signing the contract.

According to the website, almost every person is approved for a loan. However, to get a payday loan, you must:

- be at least 18 years old;

- legally live in Canada or the United States;

- earn $1000+ per month;

- have a valid bank account in your name.

Application

The application process is purely online. Loan requests are accepted 24 hours a day even on weekends and bank holidays.

You need to only follow easy steps:

- complete the online loan application at BoltPayday.com;

- click ‘Submit’ and wait for loan offers from various lenders;

- sign a contract if you are ready to accept a loan;

- repay your loan by the specified due date.

You should be ready to enter some personal details such as name, birth date, your personal phone number, phone number of your employer, e-mail address, SSN, your bank account, and others.

Participating lenders do not require any collateral, however, the matching service informs users that faxing may be required in some cases.

Repayment

Repayment terms may vary since they are regulated by state and local laws. However, payday loan repayment periods usually do not exceed 30 days. When it’s due date, the money will be withdrawn automatically from your banking account. The total repayment amount will include the original debt and interest. There are no other fees.

If you do not repay your loan on time, you will be charged additional fees. If the repayment via an electronic funds transfer fails and is returned from your bank, your bank will charge you an NSF fee for the failed payment. Your charges on the unpaid balance will grow and you will not be able to get a new loan until you have repaid the rest of the due funds.

Extension

Bolt Payday has no knowledge of loan extensions. Only your lender can provide you with information about your loan renewal extension. Each participating lender has his own policies and you need to contact him as soon as possible if you feel that you will not be able to pay off your loan on the due date. The sooner you contact your lender, the more chances you have to get a loan extension. Bear in mind, that extension can make your loan more expensive.

BoltPayday.com Bad Credit

It’s not specified anywhere on the website whether you can be approved for a payday loan with bad credit. I suggest some lender carry out creditworthiness checks before issuing a loan. I hope customers with bad credit history can also be approved because payday loans are specifically designed to help people with any credit score.

Technical Characteristics of the Website

Сonnection

BoltPayday team assures that users’ privacy and confidentiality are their priority. That’s why their site is secured with a 128-bit Secure Socket Layer (SSL) verified by Let’s Encrypt. It means that all sensitive information that you submit to this website is encrypted and that Let’s Encrypt confirmed physical location of this company and its legit activity.

I’m not fully satisfied with the encryption measures taken by this online service because the website does not have an Extended Verification Certificate, which would have allowed users to see the website’s legit owner. Besides, I would strongly recommend the company to upgrade their encryption level to 256-bit Secure Socket Layer (SSL). This will keep consumers’ sensitive information 100% safe and confidential.

Mobile Version

BoltPayday.com is accessible from both your computer or mobile device. The website has a mobile version, which was confirmed by Google:

The presence of a mobile version gives this website a number of advantages:

- You always have your mobile phone at hand: in transport, at a cafe, when walking and so on. Besides, many users prefer to use smartphones even being at home;

- The mobile website has a simplified application, which will be adjusted for any screen size;

- A high-quality mobile version is more convenient to use and is loading faster, which can please those applicants who love to save time.

Antivirus

This website is daily scanned for online vulnerabilities (viruses, trojans, worms) and reports results to the owner. The safety of this website is confirmed by Scam Bureau. This means users can feel safe when surfing this site. However, I would also recommend you to utilize a modern anti-antivirus program on your computer to avoid identity theft with a probability of 100%.

Convenience of Use

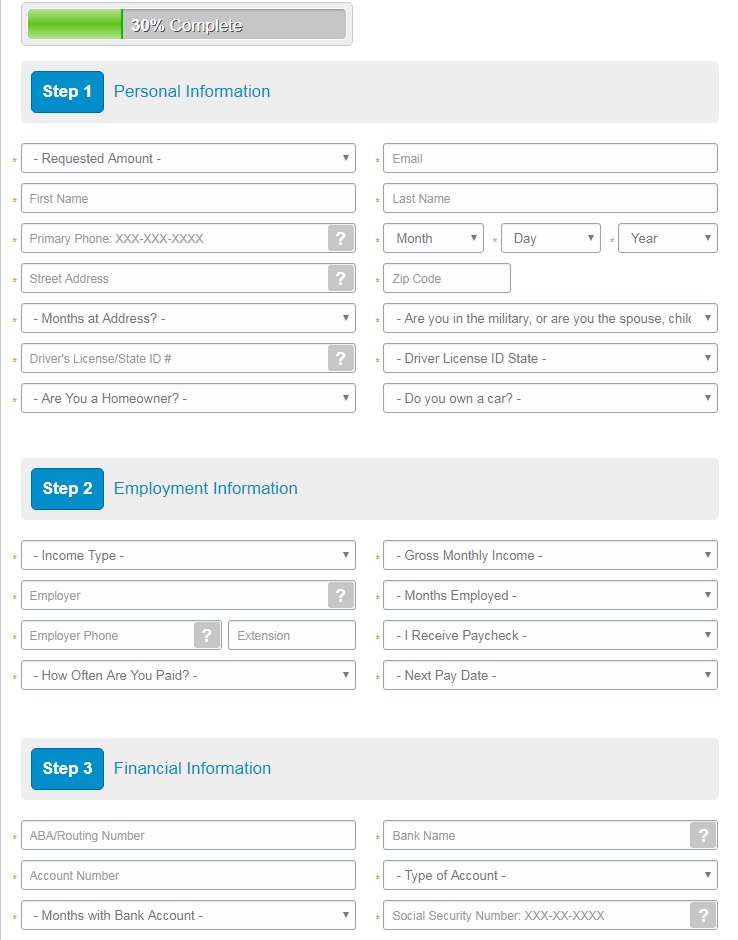

Before you can start a process, you will be offered to choose your location – the United States or Canada. After that, you will have to type in your full name and email address. The application process seems easy and simple. It consists of 3 standard blocks: “personal information”, “employment information” and “financial information”:

Once you have completed and submitted the loan request form, Bolt Payday will attempt to connect you to a suitable lender. You may also be matched with several lenders. When you find the best offer, you need to carefully read the rates and terms of your loan and accept / decline it. If you accept the offer, the funds are deposited into your banking account within 24 hours (transfer times may vary by lender).

It’s great that an application process is easy and 100% online but I do not like that you cannot see the exact rates and terms of your loan before completing an application. Besides, you should remember that this website is an intermediate party and you will be redirected to the third-party website of your actual lender.

Is BoltPayday.com Legit?

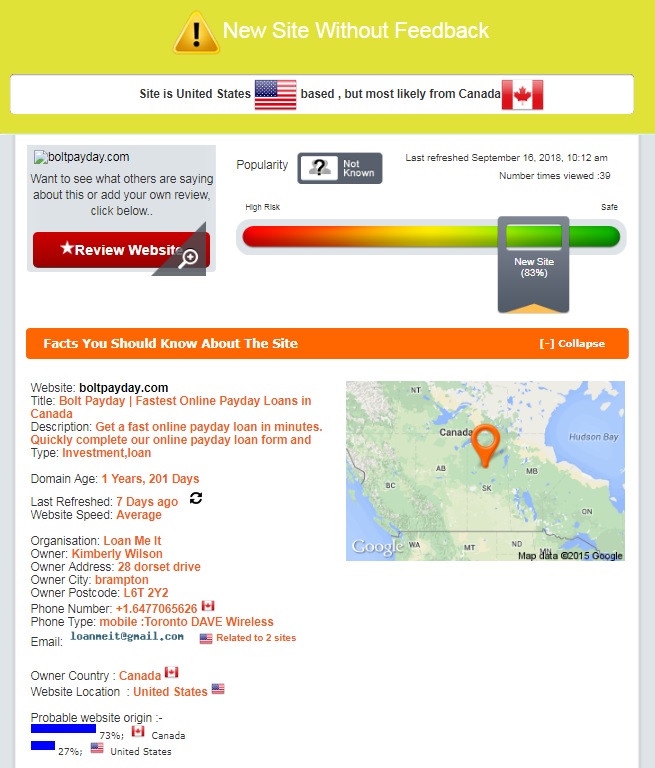

ScamAdviser i9s not fully satisfied with the legitimacy of this website. BoltPayday.com has an 83% trust-rating, which means there are some concerning issues.

According to ScamAdviser, this website is new and has no feedback. The site is owned by Canada (Loan Me It organization) but seems to be located in the United States. Its domain age is only 1 year and 200 days. You should consider this information before applying for a payday loan because not everything can be as you expect.

BoltPayday.com Reviews

On-site Reviews

Regretfully, there are no trustworthy Bolt Payday reviews on the company’s native site. It does not have a testimonial page. Instead, they placed three “user comments” from happy borrowers on the main page but it looks more like an advertisement:

I’m not quite sure how these testimonials appeared on this page. They could be composed or at least filtered by the site’s owner. For this reason, I decided to surf the net in order to find some genuine reviews I could trust.

Reviews on Third-Party Websites

Regretfully, my research confirmed the verdict from Scam Adviser – BoltPayday.com is a new website with an unestablished reputation. I found not a single review posted on independent third-party resources. Nothing testifies that this company is working illegally but I think some time should pass before I can judge about the legitimacy and real performance of this online loan-matching service.

Customer Support

Contact Information

Bolt Payday contact information is clearly specified on the website:

- Address: 250 Yonge Street, Suite 2201, Toronto, ON Canada M5B 2L7

- Phone number: 1-647-495-0509

- Email: [email protected]

Business hours are also mentioned: the company is open 24 hours a day /7 days a week (even on holidays)

BoltPayday.com Locations

Bolt Payday loans are available in the United States and Canada, however, it’s not specified residents of which states can qualify for a loan. I suppose this information also varies from lender to lender.

Getting a Consultation

If you have any questions, you can contact Bolt Payday customer support 24 hours a day, 7 days a week. The quickest way to reach the company’s representative is to call at 1-647-495-0509 or fill out a contact form: You can also email the matching service at [email protected] or mail them at 250 Yonge Street, Suite 2201, Toronto, ON Canada M5B 2L7.

I wanted to find out whether payday loans are available all across the United States. I attempted to reach the company’s representative via the specified email address but did not receive the reply.

I’m not satisfied with the customer service provided and recommend them to improve it.

Conclusion

BoltPayday.com is a loan matching service which offers residents of the United States and Canada get payday loans ranging from $100 to $2,000. I appreciate that their application process is online, simple and fast. Unlike other payday loan companies, this site is operating on weekends and holidays. However, there are some aspects that make this company unrecommended. First of all, this website has been only active for 1 year and 200 days and has not managed to gain any online reputation. Besides, Bolt Payday is not a direct lender but only a link between you and a third-party lender. Being an intermediatory, this company is not able to provide you with the exact terms, rates and fees of your loan. In addition, they do not specify whether participating lenders accept bad credit or not. For all these reasons, I recommend you looking for more reliable payday loan options.

Ready to Apply?

Ready to Apply?