What is BrightenLoans?

BrightenLoans.com is a personal loan matching service online which connects users to trusted lenders that can provide cash in a short term. This service is not a lender and does not make any credit decisions. In additions, the service bears no responsibility for the actions of any lender in the BrightenLoans network. This matching tool started its business in 2012 with a purpose to relieve stress and reduce time wasted when searching for a reliable lender who will approve an application. Thanks to the quick and easy application process, the company eliminates the need for unnecessary paperwork.

| Loan types | Min.amount | Max.amount | PeriodPeriod | APR | Documents | Poor credit history |

| Personal loans, short-term loans (payday loans, cash advances) | $100 | $5000 | Between 12 months and 30 months | Depends on the lender | SSN, Driver’s License/State ID # | Possible |

Types of Brighten Loans

BrightenLoans help people to get personal loans online (short-term loans, payday loans, cash advances) – these are small loans with a high interest rate which should be paid off on a single date (usually on the day you get paid). The service underlines that Brighten loans are issued to help people in an emergency situation and give a temporary financial relief. They are not intended to solve long-term financial problems.

Once the lender approves the application and you e-sign the contract, the funds will be deposited directly in the borrower’s banking account as soon as possible (generally, the next business day).

Terms of Use

Users applying for a short-term loan using this service can request the amounts between $100 and $5,000. Those requiring smaller sums are likely to be approved. Customers can repay the loan within the period of 12 – 30 months, which makes BrightenLoans very attractive for coping with short-term financing troubles.

The matching tool connects you with the lender that provides you with all terms, interest rate, potential late payment fees, and any other information regarding the loan offered. All these loan details differ from lender to lender and based on his own policies and applicable law. The online service does not control the lenders from its network and does not know loan terms offered by a particular lender. So we recommend you to read all terms and rules carefully before accepting the offer. BrightenLoans asks you to refuse a loan offer if you think you will not be able to repay the specified loan amount on a due date.

According to the website, most BrightenLoans lenders have the following requirements to customers:

- Be employed for at least 3 months.

- Be a US citizen or reside in the USA;

- Be at least 18 years of age;

- Have a monthly income of at least $1,000;

- Have an active checking account;

- Have a home and work phone number;

- Have a valid email address.

Application Process on BrightenLoans.com

The company has done its best to simplify an application process. They guarantee it will only take 3 minutes, and the customers can start it right on the front page of BrightenLoans’ website. It’s done in a form of a questionnaire. The preapproval online process helps users to be connected to the suitable short-term. This online application asks for some important and essential information such as name, address, phone number, an SSN number, employment details, and banking information.

Once you complete the application, you will be pre-approved immediately, and the service starts searching for a suitable lending option from BrightenLoans’ lender base.

As we have already said, users can see precise terms and rates on the website the specific loan provider, and BrightenLoans does not have information terms. Final agreement on terms and rates occur between the borrower and the lending institution. Once the lender approved your loan request, funding is usually done within 24 – 48 hours directly into your bank account.

The service mentions that some lenders from the network can ask you to provide an additional information and email copies of such documents as income verification or bank statements.

Loan Repayment

BrightenLoans a good range of repayment options available, but customers are encouraged to repay small personal loans within a short time. The lenders usually offer repayment terms not exceeding 12 months, their longest available repayment term is extended to 30 months.

Often borrowers select an ACH payment option, which means that the sum will be withdrawn from the user’s bank account on the specified date.

The online service informs that late and missed payments can affect a customer’s credit score. All lenders have their own late payment fees and policies, customers should read the loan agreement details carefully before accepting them. If clients feel they cannot make a timely payment, they should contact the lender as soon as possible to discuss a loan extension or other possible variants.

Loan Extension

Loan extension policies differ from lender to lender, some of them may offer an ability to extend a loan, and others may limit this option. Customers are recommended to consult the lender if a loan extension is possible. Bear in mind that a loan extension may involve additional fees.

If a client already has a personal loan, he can get another cash advance loans at any convenient time, but this will also depend on his state of residence and the lender’s policies. Nothing is said about the possibility of repaying your loan early, before the due date.

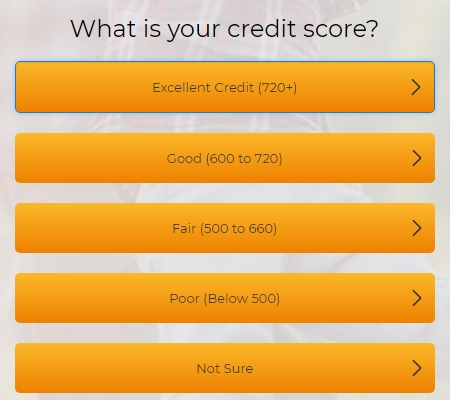

BrightenLoans.com Bad Credit

Personal Brighten loans are usually offered to customers with an excellent or good credit score, although each lender from the network has its own bad credit policies. The matching service requires the information about your credit score during the application process:

The company wants you to know that clients with a bad credit history cay have higher interest rates than those with a good credit score.

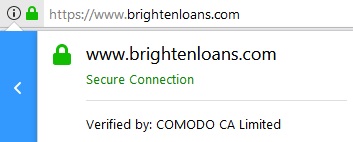

Technical Characteristics of the Website

Checking Encryption

BrightenLoans.com uses an advanced encryption technology to protect customers’ personal data. All information is transmitted and stored on the website in an encrypted format using an industry-standard 256 bit SSL encryption. The secure connection is verified by COMODO CA Limited:

The left corner of the website’s address bar contains no information about the owner but indicates a green lock which means the connection is safe.

Generally, we were satisfied with BrightenLoans.com’s security measures. However, some websites have a more advanced level of online transaction security.

Checking Mobile Version

For such websites like BrightenLoans.com, a mobile version is essential. This online matching service is mobile-friendly and can fully meet all the needs of the mobile audience. Using a mobile website, users can easily search for a reliable lender and fill in a loan application at any place which has the Internet. The application process doesn’t differ from the desktop version, the text is readable.We found no unnecessary scrolling or other bags. There is no secondary information on the main page and nothing distracts borrowers’ attention. The mobile website has successfully passed a Google check:

So, BrightenLoans.com mobile version functions well. No remarks. Probably, customers will have a good experience using this website’s version for applying.

Checking Antivirus

Regretfully, this website is not protected from viruses, which increases the risks of online thefts and hacking. Malware programs can get an access to online transactions and steal users’ personal data.

We recommend this online service to install an antivirus program since large and well-known websites usually use such programs to gain customers’ trust.

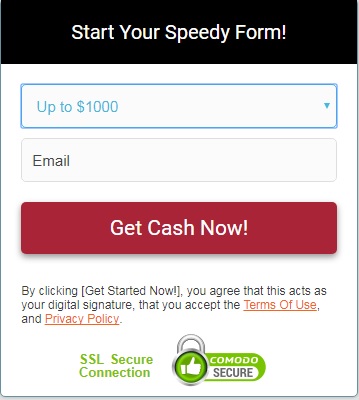

Convenience of Using BrightenLoans.com

You can apply for a loan through BrightenLoans’s website 24 hours a day without registration. To start filling in a speedy form, they will only need to enter an amount of money required and email address:

After clicking on the “Get Cash Now” button, users have to provide personal, employment and financial details. In general, the application is simple and fast.

The application does not differ from another matching website, however, you should be ready to provide your SSN number, a Driver License and mobile phone (yours and your employer’s). In some cases, customers will need an SMS verification.

In a few seconds, the service will pre-approve you and transfer you to the website of a suitable lender. In rare cases, the lender may require some additional information for income verification. After a final approval, the lender transfers the funds as quickly as the next business day.

The lender discloses the full terms and rates of a loan, but you will not any such details on the website of BrightenLoans. Be ready to have some patience and wait until you see the necessary information.

New visitors may use a special section “Questions” and find answers to the most popular question about Brighten loans. In addition, the service explains general financial terms a customer may need when signing a loan contract. Some definitions can be seen in the screenshot below:

Considering all these facts, we conclude that BrightenLoans has done a good job and simplified an application process. The website is quite informative and contains the essential information about the lenders from the network.

Brighten Loans: Legit or not?

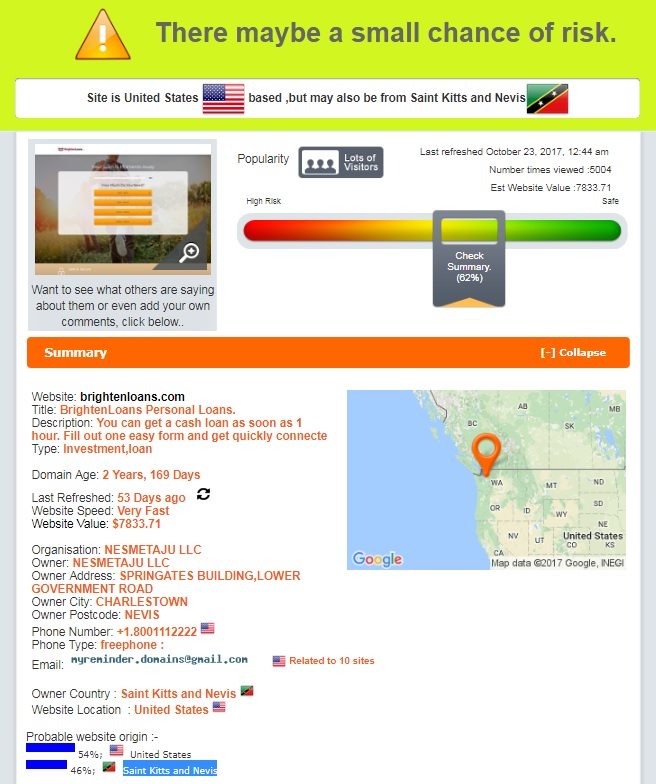

To ensure the company is legitimate, we the website’s rating using another online service – Scam Adviser. Analysis results indicate that BrightenLoans.com trust rating reached 62%% out of 100% on the safety scale, leaving the yellow zones behind.

According to ScamAdviser, there is a small chance of risk when using this service. The domain age is 2,5 years. ScamAdviser determined the website’s location as the USA, while its owner seems to be from Saint Kitts and Nevis. The website has a lot of visitors. So, there are some aspects that look suspicious, nothing indicates that BrightenLoans.com is a scam. The company seems legitimate and clients may have a successful experience with this online lender matching tool.

BrightenLoans.com Reviews

On-site Brighten Loans Reviews

No doubt, the easiest way to check the website’s reputation is to search for customer reviews. We were disappointed to find no Brighten Loans reviews on the website. People do not have an opportunity to share their positive or negative experience on the website even if they have something to say. There was only one option left – to search for testimonials on third-party websites and forums.

BrightenLoans.com Reviews on Other Websites

Unfortunately, we found no BrightenLoans reviews on the net, however, we can’t conclude that the company provides poor services. This company is not a direct lender, and people will probably prefer to leave comments about the direct lender offered by this online service. Still, we would be glad about reading some comments left by real people who say that this service is helpful and can be trusted.

Contact Us section

Contact Information

Regretfully, we found no BrightenLoans contact information on the website: no legal or mailing address, no email, no Brighten Loans phone number. Probably, the owner of the company does not feel the need to provide any contact details, because BrightenLoans is only an intermediate link between the user and the lender. However, we believe there are some cases when people would like to ask some question about BrightenLoans services and policies. The website could have at least indicated Brighten Loans contact number to become more or less transparent website.

BrightenLoans.com Locations

According to the information placed on the first page, Brighten loans are not available in all states. Residents of some particular state where such will not be offered a lender in where the service does not have lenders there. In some situations, the service may offer a loan from a tribal lender. In this case, rates and fees may be higher. Regretfully, we found no list of BrightenLoans locations. It would be desirable to see this list as soon as you visit the website. This information will allow saving time and customers will know that they will not be disapproved only because they reside in a state where these loans are unavailable.

Getting a Consultation

The company only have a detailed FAQ section which contains 15 most common questions about Brighten loans. But we found no channels of communication for customer support, as the company does not provide an email, address and a telephone. So it will be impossible to contact them for some question or advice.

Conclusion

In general, we were satisfied with the services of this company. BrightenLoans is not a lender but can connect a customer to a reputable lender who is most suitable to his needs. The loan preapproval application is quick and easy, the service is able to find a good lender within a few minutes. The website reveals general information about loans and lenders. We appreciated a wide lender network, fast preapproval, quick money transfer, a good selection of loan amounts, customers’ data protection, informative FAQ section. BrightenLoans.com seems a convenient service for people who need quick financial help. However, we noticed several areas which could be improved: the company has no channels for communication, there is no precise information about loan terms and rates, there are no Brighton Loans reviews. These drawbacks make us give only 2,6 stars out of 5 to this company.

Ready to Apply?

Ready to Apply?