What is CashCo Financial?

CashCoFinancial.com is a financial institution that offers financial tools and services to Canadians who can’t get help from banks. The company offers personal loans, cheque cashing and banking services. The lender’s head office is located in Edmonton, Alberta and serves over 140,000 clients online and in 63 locations across Canada. The company employs over 200 dedicated professionals helping customers solve any issue. They claim their entire enterprise is designed to exceed the expectations of every client. They provide help by issuing a fast loan regardless of credit history. In addition, they help consumers improve a credit rating.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Installment loans | $100 | $70,000 | Up to 60 months | Individual | State-issued ID, proof of employment and proof of residence | Yes |

Types of Loans

Cashco Financial offers flex loans. These are long-term installment loans that give a long-term financial support. Such loans can be provided for any purpose: to pay bills, make a large purchase, buy a car, start a business, and so on. Flex loans look much more attractive than other loan types because they come with lower interest rates and fees.

Flex loans can also be used to improve or create credit. With each payment throughout the period of the loan, your credit score will rise.

According to the lender, flex loans are the most flexible installment loans in Canada.

The lender can either give you cash at hand (if you apply at one of the locations) or transfer to your banking account (if you apply online). The speed of funding is not specified on the website.

Terms of Use

To qualify for a Cashco Financial flex loan, you need is to have ID (driver’s licence, passport, permanent residency card, provincial identification), a bank account, be at least 18 years of age, have an active bank account, be currently employed and have lived in your current residence for at least 3 months.

Using this company, you can get up to $7000 if you have a bank account with Cashco Financial and up to $5000 for an online loan.

All flex loans have a 40.99% fee + interest when you delayed a payment for any reason. The lender gives a representative example for a $1000 loan taken for 2 weeks:

Application

You can apply for a loan at one of the locations or through the website.

You can fill out an online application in seconds. During application, you will need to provide basic personal details, residence and employment information, and specify the ways of contacting you.

The company does not require to fax any documents to verify your identity. Once you apply, they start processing your application and try to approve it as quickly as possible. Then the lender transfers the money into your account.

Repayment

Cashco Financial flex loans are repaid by an automatic withdrawal of funds from your banking account on due dates that are specified in your contract. You can pay off your loan in affordable installment payments over 60 months.

The lender mentions that such loans are flexible and can fit the needs of every customer. You can choose an individual payment schedule that is convenient for you and flexible loan terms.

Regretfully, I found no information about fees and charges for a missed/delayed payment or non-payment. Cashco collection policies are also not specified. You need to clarify these details before signing the contract.

Extension

Unfortunately, it’s not mentioned anywhere on the website whether CashCo Financial allows loan extension. I know that loan renewal terms are regulated by state so you should read your contract carefully before signing.

There is no information about the possibility of repaying your loan before the due date.

CashCoFinancial.com Bad Credit

Cashco Financial claims you should not worry about having a bad credit score. The lender looks at many factors and always tries to approve applications. Even more, you can improve your credit score by making each loan payment on time. This is reported to the Canadian credit bureau so your credit score will rise on each successful payment. Flex loans can be used both to create credit or improve bad credit. This is one of the main benefits of this lender.

Technical Characteristics of the Website

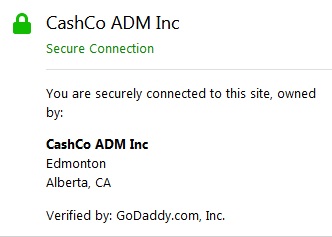

Encryption

Cashco Financial takes the privacy of borrowers seriously. They claim that their data and information are safe with them, and your connection to this site is secure. The site uses a 256-bit Secure Socket Layer protocol verified by GoDaddy.com, Inc.

Using the HTTPS protocol to protect personal data increases the trust of the user to the resource. This method establishes certain rules for exchanging data between the client and the server. It encrypts information, reducing the risk of data theft.

The encrypted protocol ensures the reliable safety of any information. Potential customers trust the resource, which has a secure connection icon – a green lock.

Besides, the website has a certificate with extended company verification (EV), which confirm the ownership of the domain, information about the organization, as well as its legal status. This type of certification provides the highest level of security, identifying the company behind the domain. In this case, the address bar of the browser contains the name of the organization, notifying the site visitors that they are dealing with a trusted company in a secure domain.

Mobile Version

According to statistics, 69% of mobile phone owners use their devices to access the Internet. This statistic proves that the online companies need to have a mobile-friendly website, otherwise they risk being outperformed by competitors.

CashCoFinancial.com mobile version is a copy of the standard version of the site, adapted for mobile devices. The user receives unlimited content, which is conveniently viewed.

Advantages of the mobile version:

- user-friendly, because it’s much simpler than the regular version. The mobile version displays the most priority information and also allows you to apply for

- a loan with a minimum of actions;

- it is easy to make significant changes because this is a separate version and you do not need to make changes to the main site;

- fast loading of pages, as all necessary elements have less weight;

- it is possible to go to the full version of the site;

- the mobile version meets Google’s requirements for viewing convenience on mobile devices;

- dynamic site layout, the viewport automatically adjusts to the screen sizes so that the user can avoid horizontal page scrolling and zoom;

- automatic font size change;

- convenient design of interactive elements (buttons, etc.), located at a certain distance from each other, so that you can click the required area.

Antivirus

Regretfully, the website does not have an antivirus program, which means its users are not protected from viruses, spyware, and other threats. I would strongly recommend the website’s administration to provide customers with more safety during online transactions.

Convenience of Using CashCoFinancial.com

Before starting an application process, you will need to register on the website. If you have already used the services of this online lender, you can simply log into your personal account.

The application process is convenient and intuitive. It’s nice that the lenders do its best to approve applications within minutes. Once approved, the funds are transferred to the borrower’s banking account shortly after.

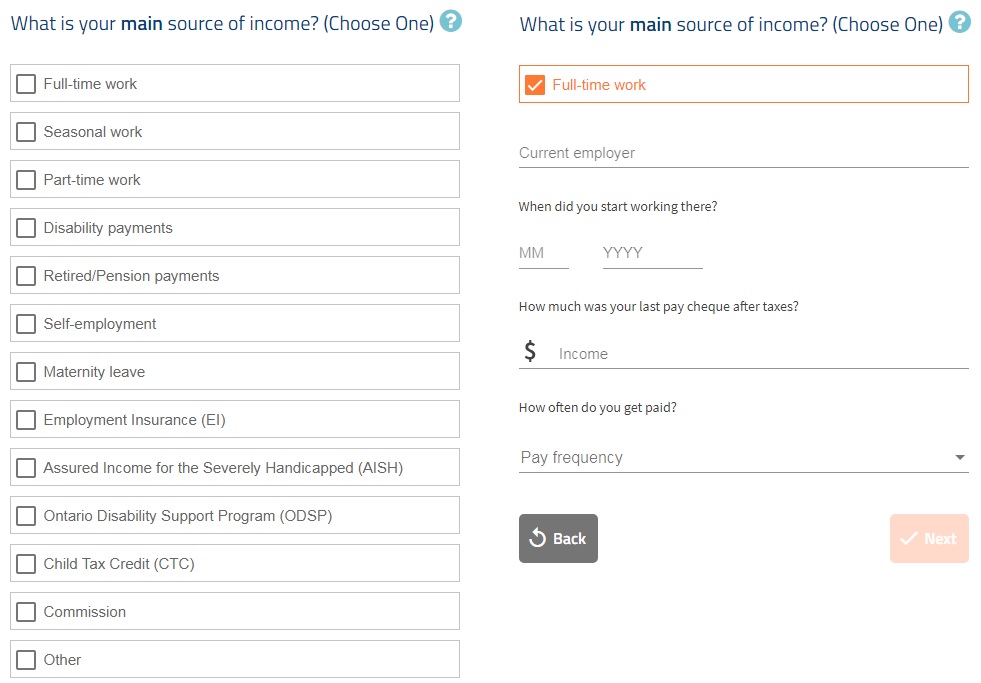

However, I noticed that a borrower has to fill out many personal details, which significantly prolongs an application process. Below you can find a representative example of what employment details you will need to provide:

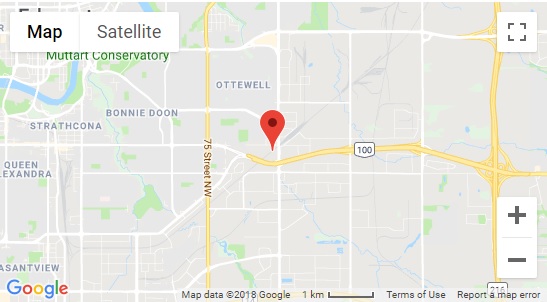

I appreciate that the lender provided a useful tool which allows customers to find the nearest CashCoFinancial location within seconds:

Another pleasant bonus is that every time you refer your friend or relative for a loan and if they are approved, you can earn money. You will get $25 for a flex loan referral, $20 for a short-term loa referral, and $10 for cheque cashing referral.

CashCoFinancial.com can be considered an informative website, however, some loan details still need to be specified: extension policies, early loan repayment, and so on.

Is CashCoFinancial.com Legit?

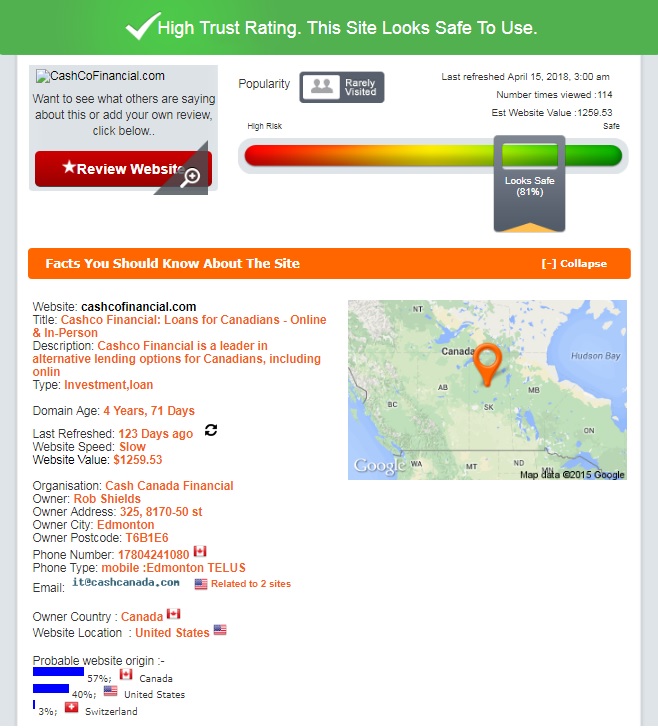

ScamAdviser gave CashCoFinancial a high trust rating of 81% out of 100%:

According to ScamAdviser, this website is legitimate and safe for use. The domain was created over 4 years ago. The website is owned by Cash Canada Financial but according to ScamAsviser, located in the United States. Besides, it may somehow relate to Switzerland All these issues resulted in only an 81% trust rating, which is, however, a good result. I found no evidence that this lender is working illegally.

CashCoFinancial.com Reviews

On-site Reviews

Customer reviews would be the most reliable way of checking the company’s reputation and real performance. Regretfully, the native website of this lender does not have a testimonial page and respectively no CashCoFinancial reviews. Borrowers cannot post their comments, complaints or suggestions on the official website of the lender. I would recommend the website’s owner to create a separate testimonial page for customers’ convenience.

Reviews on Third-Party Websites

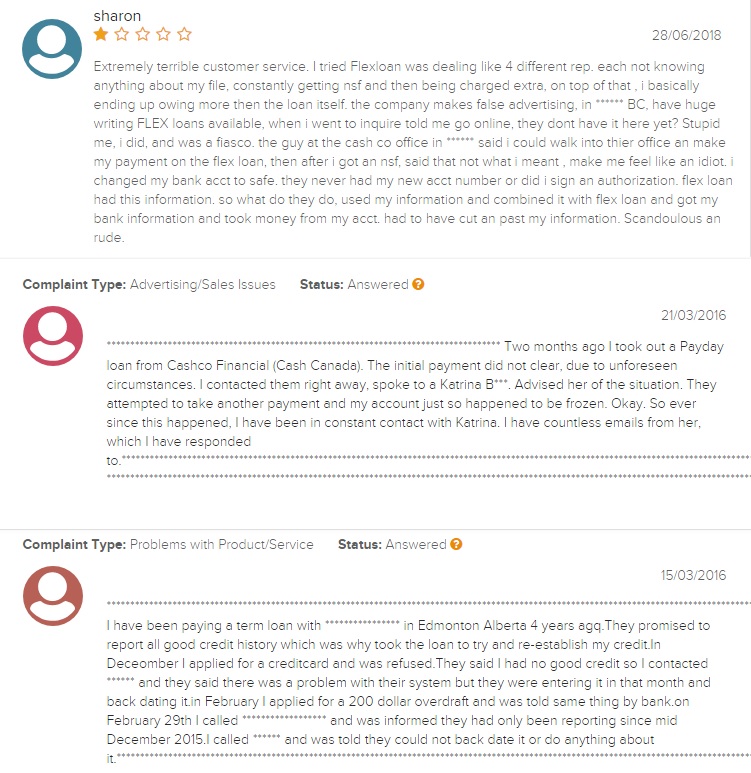

Searching for CashCoFinancial reviews on third-party websites was more successful – there are several comments posted by former clients of this lender, however, all of them are negative. These users were dissatisfied with the services provided and do not want to use this lender again.

Sharon posted a review in 2018 which reported that this company had “an extremely terrible customer service”. She was dealing with 4 different managers and nobody knew anything about her loan. Besides. She mentioned that this lender made false advertising. Finally, she had to repay a huge sum of money. Sharon concluded that her experience with this organization was a fiasco.

Another user from 2016 posted a CashCo Financial complaint. He also had an unpleasant experience with their customer support. The borrower had some difficulties with making payment on the due date and contacted the manager immediately, but his problem was not solved. Instead, the situation only became worse.

The last reviewer from 2016 was also upset with the services provided. He said the lender promised to report his successful payments to credit bureaus and improve his credit history but failed to keep their promise.

I conclude that CashCo Financial is not always able to satisfy the needs of every borrower. However, these reviews proved that this is a real organization which issues flex loans.

Customer Support

Contact Information

The website contains all the contact information of CashCo Financial.

Their head office is located at #325, 8170 50 St.Edmonton, Alberta, T6B 1E6. You can even see the location on the map:

CashCo Financial phone number is 1-855-914-7940, a phone number for general inquiries is 1-780-424-1080, their online department can be reached at 1-855-525-3410, flex loan department – at 1-844-456-1504.

The mention that hours of operations vary by branch so you need to specify this information before applying for a loan.

CashCoFinancial.com Locations

CashCo Financial provides flex loans to residents of British Columbia, Alberta, Saskatchewan and Ontario. All in all, the company has 63 locations across Canada. Their addresses can be found on the website. Moreover, you can easily find the nearest location in your province.

Getting a Consultation

If clients have any questions, concerns or suggestions about flex loans or application, they may speak to a live agent by calling at 1-855-525-3410 or fill in an online feedback form and receive an e-mail response.

A live chat option is unavailable so I had to leave my question offline using a feedback form. I was interested in whether this lender allows loan extensions. Unfortunately, the customer support team did not answer my question within the specified time. This means that their managers are unable to provide fast customer support.

Conclusion

CashcoFinancial.com seems to be a legit lender and a good option for Canadians who wish to improve their credit score. Their website is easy to use and they have many in-store locations across Canada. I appreciate that the lender is trying to be transparent and has nothing to hide. Their main downside is that their customer care department is not as speedy as you may expect. Besides, there are only negative customer reviews on the web, which undermines the reputation of Cashco. In general, this website produced a good impression on me but I still recommend you to be cautious when applying for a flex loan with this company.

Ready to Apply?

Ready to Apply?