What is Cash Factory USA?

![]()

Cash Factory USA is a licensed credit services organization in Ohio and Texas and a licensed credit access business in Texas. They are also a member of the Community Financial Services Association of America. The company helps residents from various states get loans from trusted third-party lenders. They actively support laws and industry best practices that protect customers and provide access to reliable credit options.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Payday loans, installment loans | $100 | $1,000 | Up to 180 days | Varies | Social Security Number | Possible |

Types of Loans

Cash Factory USA offers payday loans and installment loans. In addition, they provide NetSpend pre-paid debit cards and check cashing for regular payday clients.

- A payday loan is a small short-term loan which usually does not exceed $255 (depending on income and location). Such loans are designed to help consumers pay for unexpected expenses until their next payday. The original loan + interest are repaid on a customer’s next payday;

- An installment loan is a loan of a higher amount which is repaid in several scheduled equal installments. The number of payments will depend on the frequency of your paydays.

If your application is received by the lender by 4:30 p.m. PST, you will generally receive your funds on the next business day. However, in some cases, it may take longer. You can ask the lender to specify this information.

Terms of Use

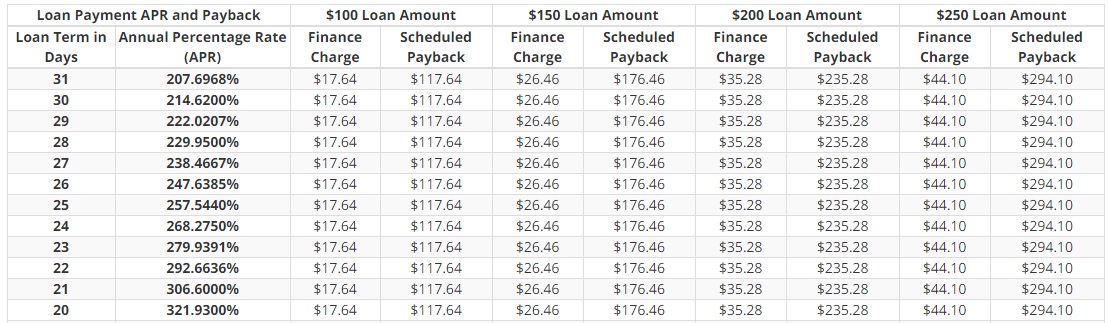

Each state has its own fees and interest. You can visit the Rates page which is available at CashFactoryUSA.com and check the rates and fees for your state. Below you can see a part of a table for California residents:

Approval amounts will depend on the details you provided in your application, state laws, and your income. A payment due date/schedule will be specified in your loan contract.

I like that this website gives detailed rates and terms for each state:

California residents:

- Maximum loan amount – $255;

- Maximum loan term – 31 days;

- APR — 207% – 1,287%.

Missouri residents:

- Maximum loan amount – $1,000;

- Loan term – 120-180 days;

- APR – 542% – 546%.

Nevada residents:

- Maximum loan amount – $1,000;

- Maximum loan term – 35 days;

- APR – 343% – 3,647%.

Under Nevada law, all residents of this state must provide a proof of income when applying for a loan through this website.

Ohio residents:

- Maximum loan amount – $1,000;

- Maximum loan term – 180 days;

- APR – 425% – 454%.

Texas reidents:

- Maximum loan amount – $1,000;

- Maximum loan term – 45 days;

- APR – 226% – 3,661%.

Utah residents:

- Maximum loan amount – $1,000;

- Maximum loan term – 35 days;

- APR – 286% – 3,647%.

Under Utah law, all residents of this state must provide a proof of ability to pay off the debt when applying for a loan through this website.

According to Cash Factory USA, all borrowers can cancel the loan for any reason. For this, they must send a request in writing. The policies also vary by state:

- California, Nevada, Missouri, Utah – You may cancel the loan and return the loan amount by 5pm of the next business day;

- Ohio – You may cancel the loan and return the loan amount within 3 business days after the loan contract is signed;

- Texas – You may cancel the loan and return the loan amount by midnight of the 3rd day following the date on which the loan contract is signed.

Application

The application process is purely online and takes a couple of minutes.

To be verified for a loan with Cash Factory USA, you should provide the following information in the online request form: full name, birth date, physical address, email address, telephone number, Social Security number, information about your income and its frequency, bank account details.

You must provide an accurate information if you want your loan to be approved. Besides, it will influence your maximum loan amount and the number of installments.

Fortunately, the lender does not require any collateral. Besides, you are not required to fax any papers.

Repayment

Typically, your loan due date(s) will be scheduled on each of the days you get paid. A precise schedule will be listed in your contract. The funds will be automatically taken from your banking account via ACH (original amount + interest).

If you wish you can repay your loan early, before the due date, without any penalty or fee.

Bear in mind that late payment/non-payment could incur penalties, additional fees or even collection actions. The lender claims they will work with clients to establish new payment schedules. Besides, they guarantee that their collection measures are carried out in a professional and legal manner.

Extension

Depending on your location, you may be eligible to extend your payday loan. Installment loans cannot be extended.

- California – You may not extend your loan;

- Missouri, Ohio, Texas – You may extend your payday loan;

- Nevada – You may extend your payday loan up to 4 times as long as the total number of days from your due date and all your renewals cannot extend 90 days;

- Utah – If you qualify, we may allow you to extend this Short-Term Loan up to 4 times as long as the total number of days from your due date and all your renewals cannot extend 70 days.

You can get another loan with Cash Factory USA 4 business days from the date you repaid your previous loan. If you apply for a new loan after 3 days or less, the lender will ask you to send a bank statement showing proof of your previous loan repayment.

CashFactoryUSA.com Bad Credit

The lender checks your credit, verify your identity and look at your loan history but they do not use traditional credit bureaus. Instead, they use specialized credit bureaus. However, they do not mention terms and rates for consumers with bad credit and their chances to be approved for a loan.

Technical Characteristics of the Website

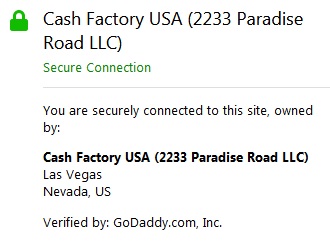

Secure Сonnection

Cash Factory USA utilizes the most advanced encryption technologies: a 256-bit Secure Socket Layer (SSL) and an Extended Verification Certificate, provided by GoDaddy.com. This means your personal details will not get into the hands of unauthorized third parties.

I appreciate that the lender has a responsible approach to providing safety to customers and takes care of their privacy.

Mobile Version

The website is mobile-friendly, which gives applicants inarguable advantages:

- the content is adjusted for a mobile audience;

- you spend less traffic;

- the mobile website is loaded faster;

- there is no horizontal scrolling;

- links and elements are not too close together;

- font and pics are enlarged.

So, if you prefer to apply for a loan using a smartphone or a tablet, you will unlikely have any difficulties with this website.

Antivirus

Every day, new online threats and vulnerabilities appear. In our time, new viruses, worms, bots and trojans are created constantly and, as a rule, they are intended for committing an organized crime. The hackers spread viruses for completely different goals and consequences for the average user. Therefore, even the most cautious users may be subject to attacks. In other words, you may infect your computer by simply visiting a website. Even the largest and most trusted Internet portals like CashFactoryUSA.com can distribute dangerous software without even knowing it. They often try to install malicious spyware, trojans, rootkits and other various programs for hacking PCs. Nowadays, malware is an area of organized crime that collects all information about you, including financial information, identity information in order to harm. Antivirus would have been your last level of protection. It would have been able to protect you from online attacks,”catch” and prevent the installation of a malicious program before it can do any harm. Regretfully, this website does not utilize any antiviruses and this is a serious drawback.

Convenience of Use

The website seems simple and convenient to use, however, if you are a new customer, you will have to register and create a personal account. If you are a returning client, you take advantage of a quick application. For this, you should click on Member Area at the top right corner of the site and log in:

Once you have completed all the empty fields, you will receive a notice reporting if you have been approved for a loan online. Some moments later, you will get a call from a Cash Factory USA representatives to check and finalize your application.

I like that this website is VERY informative and presents rates and fees for each state the lender does business in so that you can see the terms you are getting into in advance.

Is CashFactoryUSA.com Legit?

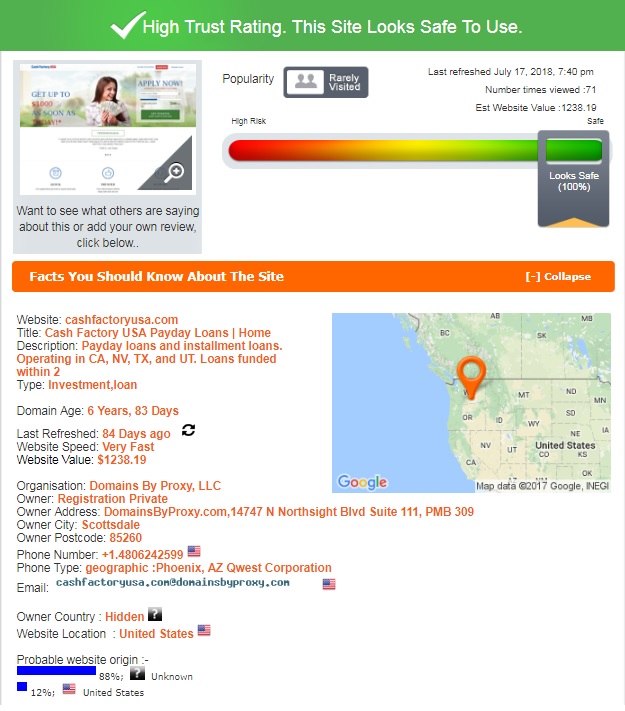

ScamAdviser reported that this website has a 100% trust-rating, which means this online portal is safe to use.

According to the report, this lender has been active for 6 years and the website is located in the United States. Its loading speed is very fast but it has a few visitors. Besides, its owner is hidden. Still, ScamAdviser gave a perfect trust-rating to this company. Although some information remains unknown, there is no evidence that this website is operating illegally.

CashFactoryUSA.com Reviews

On-site Reviews

Most people prefer to use lenders with a good online reputation. Numerous good reviews are the best proof of the legitimacy and reliability of the services provided. Borrowers always search for a testimonial page where customers shared their experience and advice. If the number of testimonials is impressive, this means that the lender is popular and able to provide good loans. Regretfully, I found no CashFactoryUSA.com reviews posted on the native site of this company.

Instead, the “Testimonials” page contains some reviews copied from TrustPlot.com, which is a third-party website. I analyzed independent reviews in the next unit.

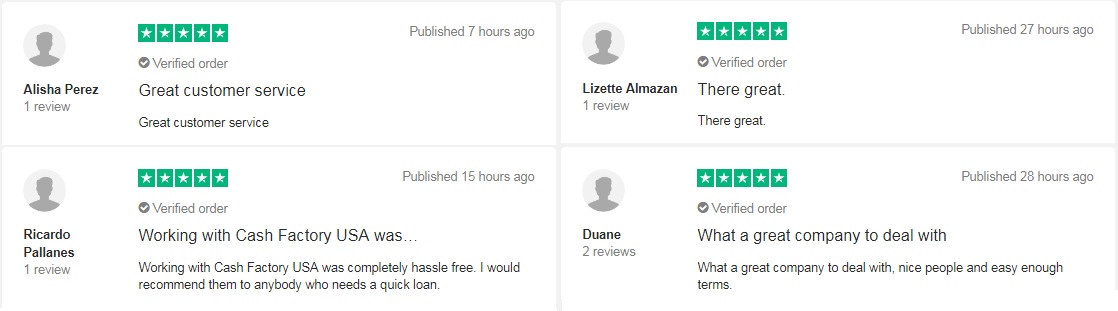

Reviews on Third-Party Websites

Since this online lender has been operating for 6 years, I hoped to find many Cash Factory USA reviews posted on independent websites on the web. Indeed, their amount was impressive: I found about 500 comments from previous clients and 95% of them were positive.

The first comment was posted by “Raymond” in July 2017. He said he had a great The most recent review was posted by Alisha Perez in 2018 on TrustPilot.com. She reported that this lender had a great customer service. Duane said it was a pleasure to work with this company. Ricardo said his experience with this website was completely hassle-free.

However, a few users were disappointed with the services provided. ToddMcKinnin reported that Cash Factory USA made an error by not processing his payment in a timely manner and this caused additional fees. He added he would never use their services again. Cheryl Barringer said he was misled during application and had to pay a CSO fee. Sarah Collins claimed that she expected to be approved for a higher amount. Shonda Shimek complained of the delayed funding – they promised to send funds on Thursday but it was Sunday and she still did not have her money. She said she would never use them again.

In general, the lender’s reputation is good. Although customers posted a few complaints about their services, their number is very limited and most of them were about technical problems. I found no proof that this company had any legitimacy problems.

Customer Support

Contact Information

The lender’s in-store location is 6965 S. Rainbow Blvd Suite 130 Las Vegas, NV 89118.

They specified their Call Center working hours: Monday to Friday – 5AM to 7PM, Saturday – 5AM to 6PM, Sunday – 5AM to 6PM.

Cash Factory USA phone number: 1-855-374-5626, fax: 1-888-400-7552, email: [email protected]

Locations

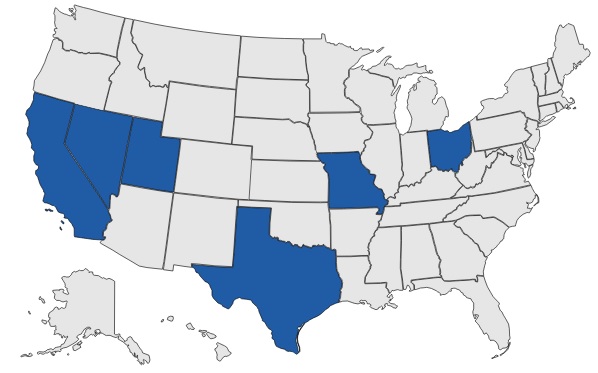

Cash Factory USA payday loans are available to residents of California, Missouri, Nevada, Ohio, Texas, Utah.

This lender does not operate in Alabama, Alaska, Arizona, Arkansas, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

Getting a Consultation

If you have any questions, yo0u can contact the customer care department at 1-855-374-5626, fax at 1-888-400-7552, send an email to [email protected]. Ohio residents should call at1-855-562-6033 or send an email to [email protected]. You can also use a contact form available on the website.

I tried to reach their customer service group by using a contact form. I asked them to specify the chances of consumers with bad credit to be approved for a payday loan. The answer never came. Of curse, you can try to reach them over the phone but I was interested in online consultations.

Conclusion

CashFactoryUSA.com seems a legit and informative website. Applying for a loan is simple and convenient, especially for returning clients. I like that customers have several options to choose from: payday loans and installment loans. Applicants can get a decision in a few minutes and even get the funds the same day. The advantage of this service is that it has a perfect online reputation from ScamAdviser, which means it’s legal. The lender specified all rates and terms in advance thus you give a chance to make an informed decision regarding your finances. Bear in mind that short-term loans may come with high interest rates. The disadvantage of this company is that their loans amounts cannot exceed $1,000, so if you need a higher amount, this website is not suitable for you. Besides, they are only available in 6 states and you should check up this list before applying. Additionally, I disliked their customer service since I failed to contact their representatives. In general, Cash Factory USA is a good lender that has helped a lot of consumers get the money they needed urgently. The website is transparent and no information is hidden. I was concerned a bit with a few complaints posted in 2018, so you should review this information before making a decision about using this online service.

Ready to Apply?

Ready to Apply?