What is Cash Float?

Cash Float is a loan company which was designed to provide people with loans online. The company was founded and operates in the UK. It is registered as Western Circle Ltd., but everyone calls it by the trade name, Cashfloat. It is a direct lender authorized by the Financial Conduct Authority which means that the FCA has given CashFloat a full permission to supply consumer credit and trust the lender to be doing this super-responsibly. The lender is also a

BCCA member, a subsidiary of Media Financial Management Association, which represents credit and collection professionals that provide services both locally and nationally. With the company’s payday loans, clients can benefit from instant savings at any time. According to them, their business model is based on advanced technology and fundamentally good morals. CashFloat is proud of a fine-tuned approval process, affordable, safe and reliable payday loans. The company ensures clients that they receive the best payday loan for their needs when taking a loan with Cash Float. They emphasize that they are different because they care. The company invests a lot in education to help their clients save money and manage their finances. CashFloat.co.uk promises that it never takes advantage of people in an unregulated market. In addition, they never charge an application fee or provide the clients’ personal details to the third parties.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Poor credit history |

| Payday loans, installment loans | £200 | £1100 | Up to 45 days | Payday loans – 24% , other loan types – 997% | On the lender’s request | Yes |

Cash Float Loan Types

Cash Float offers a rich selection of loan types to its clients:

- Payday loan is a small, unsecured loan that has a high rate of interest and should be repaid on a single date;

- Short-term loan is an alternative to common payday loans. Short term loans can be repaid in several instalments. For many people, it is much more convenient to return their loan in several monthly instalments, rather than one single repayment. Short-term Cash Float loans are convenient, but they are expensive. They are suitable only for short periods when there are unexpected expenses, but they should not be long term. Clients should bear in mind that the longer they borrow money for, the higher interest rate is;

- Loans online are speedy and focus more on affordability. Clients can simply fill in the application form on the website and wait for an approval and money funding;

- Cash advance is a small loan borrowed at an agreed price. If clients ran out of money before payday and need to pay for some important bills or have unexpected expenses, they can take an instant cash loan from CashFloat.co.uk;

- Personal loans mean the larger amounts than the average payday loan. A personal loan is a loan that is used for the client’s personal use, not for business or commercial purpose: a fast car repair, buying an expensive new item, buying a present to your friend’s birthday and so on;

- Small loans are short-term loans that help people cover a temporary shortfall in money. With a small loan from CashFloat, people are buying some extra cash to pay for expenses that their regular income cannot cover.

The company guarantees that it does not take long to check an application. It depends on the number of applications they have. Usually, it takes 1-3 hours to get an approval. CashFloat understands that a client needs the money fast, that is why their trained team works at top speed to provide clients with money as soon as possible. Once a client has been approved, money will be funded to his banking account quickly, usually the next business day. It depends on the lender.

CashFloat also gives recommendations on how to choose the best loan option. For example, if a client needs a small amount and he is sure he’ll be able to repay the money at his next payday, then the option is a payday loan.

Terms of Use

To get an online loan from Cashfloat.co.uk, clients need to meet the following requirements:

- Be a UK citizen;

- Have a UK banking account;

- Be at least 18 years of age;

- Have a full-time job

The company specifies that first-time Cashfloat users can borrow between £200 and £500. Repeat customers can borrow up to £1100 (997% APR). The more they borrow, the more they’ll have to pay in interest. The company guarantees the minimal interest rates for payday loans – with the new FCA cap, the payday loan interest will NEVER exceed 24%.

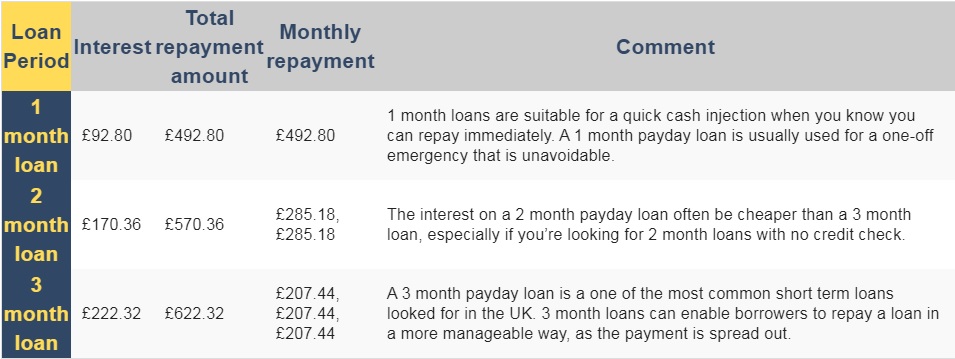

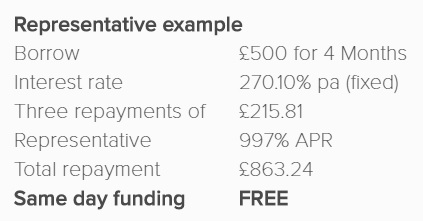

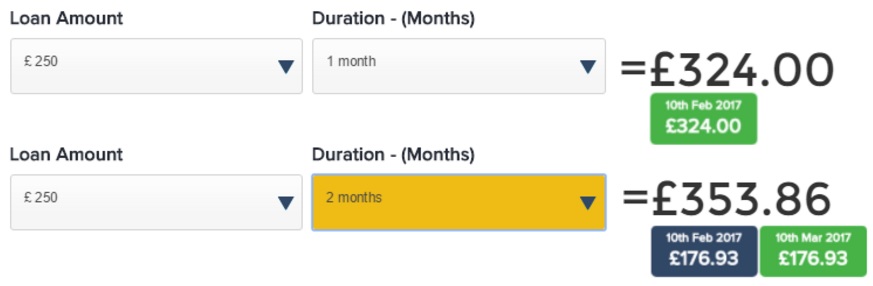

Cashfloat provides 1-month loans, 2-month loans and 3-month payday loans, that have different terms and rates. The company gives a representative example for a £400 loan with Cashfloat:

Various options for loan periods may seem a very attractive option for many customers.

Application Process on CashFloat.co.uk

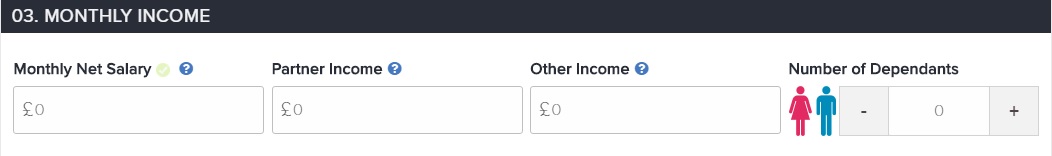

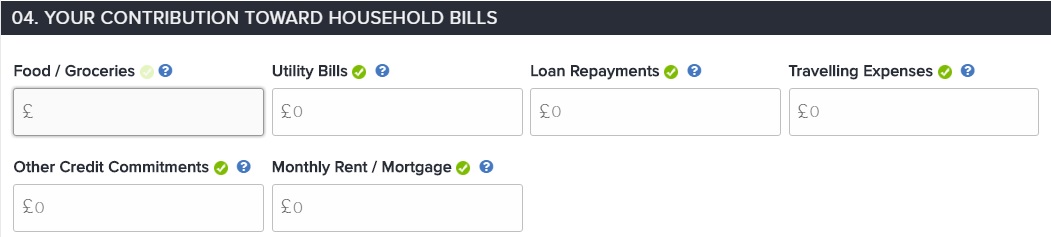

Cashfloat guarantees that applying for an online loan on the website will only take you a few minutes. Clients do not need to register or invent Cash Float login to apply for a loam, they only have to complete a simple loan application available on the front page. They do not need to provide any documents, but if the lender has any queries, the underwriting department will call him. The users only need to provide the following information: Your loan details, Personal details, Employment details, Banking information and even Your Contribution Toward Household Bills and Monthly Income information (including Child benefits, Overtime, Bonus, Working Family Tax Credit, Pension, Extra work and so on):

Thus, the company wants to make sure the client will have enough money to repay a loan. Many clients will appreciate that Cashfloat.co.uk requires no faxing and no personal reference.

We also like that the lender has provided the detailed information about the loan approval terms. If clients submit an online application at weekends, after 5:30 pm, or before 9:00 am, Cashfloat team will process it only the next working day.

Loan Repayment on CashFloat.co.uk

To make things easier, the lender offers various methods of loan repayment. They inform the clients that the easiest and most common loan repayment way is via debit/credit card. Clients can also make a payment via the Internet or at any Barclay’s branch into Barclays Account, Sort code: 20-78-98, Account details: 43469689.

A client does not have to worry about just forgetting to pay since Cashfloat will call him on the day his loan was due if it hasn’t yet received the payment. They call it «a friendly reminder» to pay for a loan before they start incurring charges.

Cashfloat allows its clients to pay back a loan earlier which can save them a lot of money. Once again, they emphasize that they do care about their customers.

The company even promises to freeze your loan in case you lost your job. Not every lender is ready to do so. The customer is also allowed to repay his loan the same day FOR FREE if possible.

Does Cashfloat Offers Loan Extension?

In the FAQ page, the lender mentions that he understands that the client may have some unexpected circumstances that will not allow him to repay his loan on the due date. In this case, Cash Float promise to do everything to help him. The client just needs to call Cash Float customer support service several days before his payment due date. If he does not inform the online lender about his inability to repay a loan, Cash Float can start collecting penalties. The main page of the website warns the clients that late repayment can cause them serious money problems.

So, the main thing is to LET THEM KNOW. As written on the website, if a client calls the lender, its friendly call team will offer him several low or no cost options such as a penalty-free grace period up to 5 days and breather space upon request.

If a customer doesn’t let Cashfloat know, the company will charge him £15 automatically and then will be a daily default interest of 0.74%. If the client refuses to pay, the lender may start legal proceedings in the form of a County Court Claim and an attachment of earnings. The lender will have to report to the CRA about a failed loan repayment.

Unfortunately, Cashfloat does not approve a second loan until the current loan is fully repaid.

CashFloat.co.uk Bad Credit History

People can apply for a loan through CashFloat even if all banks and credit card companies have refused their requests for credit. CashFloat bad credit direct lenders may approve an application even if you have a poor credit history, but they are still required to conduct a comprehensive credit check.

The company understands that it’s actually quite rare to find a client with a perfect credit history. Some of the important factors they check are whether a client has any recent defaults and whether he has ever had a CCJ.

From the information they give on the site, we can learn that the definition of CashFloat bad credit is individual and flexible. Sometimes, a bad credit loan approval depends on the amount. A person might be eligible for a loan of £500, but not eligible for a loan of £1,000.

Technical Characteristics of the Website

Is Cash Float Safe in Terms of Connection?

CashFloat.co.uk uses a 128-bit SSL encryption which secures users’ personal information (login, password, name, address, banking information and so on). The security certificate is verified by GoDaddy.com, Inc. The left corner of the address bar indicates the name of the website’s owner – Western Circle Ltd. This means that CashFloat uses the Extended Verification Certificate, which requires much more careful verification of the website’s owner.

Unfortunately, a 128-bit SSL encryption can’t be considered the best encryption. However, for practical purposes, 128-bit keys are sufficient to ensure data security.

Mobile Version

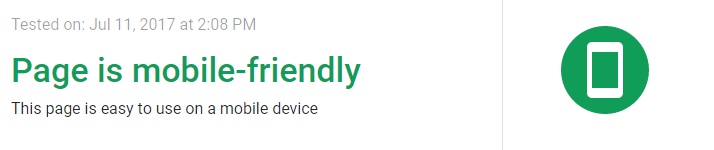

For online lender websites, a mobile version is vital. That’s why we checked the mobile version of CashFloat.co.uk. The website has successfully passed a Mobile-Friendly Google Test:

The mobile version of the website is adapted for mobile users. People visiting the website from mobile devices do not need to scroll the pages since everything is displayed correctly and the functionality works properly. Using CashFloat.co.uk mobile version, it is even more convenient to use the menu and read the company’s description.

Checking Antivirus

The owner of CashFloat provided has no antivirus on the website, which means clients can easily catch malware or viruses on their computer. This is a serious disadvantage, as large and respectful online lender websites usually use antivirus programs. The company needs to fix this drawback to gain a better reputation. So far, CashFloat.co.uk can’t be considered the safest place to apply for a loan online.

Convenience of Using CashFloat.co.uk

The first advantage of applying for a loan with CashFloat is that the users do not need to log in to start a procedure. Registration is only necessary for those people who have already taken a loan from Cashfloat and wants to create a personal account to get a full control over his loan.

The company tries to give as many representative examples as possible and that is to be praised. For example, another table shows the terms and conditions for a client who takes 500 pound for 4 month. This table will bring about increased understanding of Cashfloat policies:

The lender understands how important it is to understand how a loan works before application. Every client has a personal Cash Float calculator which allows to learn all the details he needs to know about his loan. Cash float formula allows clients to control over their loans and handle repayments easily.

Considering all the above facts, we can conclude that the online company has taken many efforts to provide customers with convenient loans online.

We can say for sure that CashFloat.co.uk is a very informative website. The company has its own blog devoted to loans, it also explains all the peculiarities and differences between all types of Cash Float loans in detail. Clients can find a comprehensive information about the loans on the FAQ page.

In general, an application form is quick and simple and does not require much time.

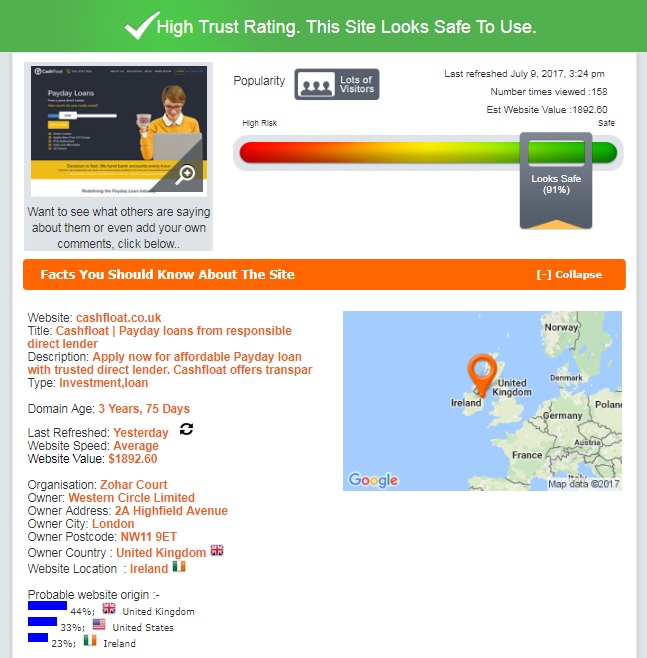

Is CashFloat.co.uk Legit?

We checked CashFloat.co.uk legitability using ScamAdviser.com and were happy to see that the online service has a 91% trust rating out of 100:

According to ScamAdviser, CashFloat.co.uk seems safe to use. The owner country is the United Kingdom, and the website location is Ireland. The domain age is more than 3 years. The website has lots of customers and is constantly refreshed. Scam Adviser recommends users checking the information about the website carefully since there are other countries involved in this business. Still, a 91% trust rating is a good indicator which means the company is legitimate, and users can most likely have a positive experience with this online lender.

CashFloat.co.uk Reviews

On-site Cash Float Reviews

We found no CashFloat.co.uk reviews on the website itself. The website had no section where users can share their experience. And that is a pity, since customers reviews is an integral part of any online service, because all clients would like to read what other people say about its services – sometimes it is even a decisive factor in choosing a lender. Reviews is the best way of ensuring the reliability of the online company. We can’t assess the reliability of this online service basing on user reviews, as not a single user shared his experience with CashFloat.co.uk.

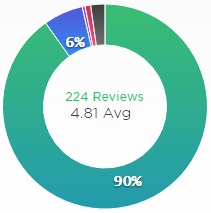

CashFloat.co.uk Reviews on Third-Party Websites

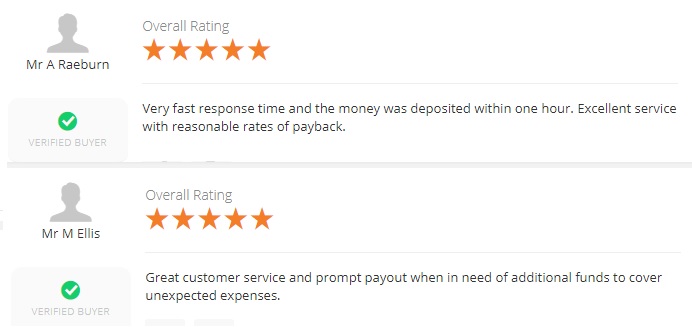

We decided to check the reputation of CashFloat basing on outside customer reviews. First of all, we decided to follow advice of the company and get acquainted with CashFloat comments on www.reviews.co.uk. It turned out that the online lender is rated 4.81 based on 224 reviews:

The most reviews are positive and are being posted on the website every day. Most users are completely satisfied with the services provided, namely, very fast response and funding, reasonable interest rates, great customer support and more:

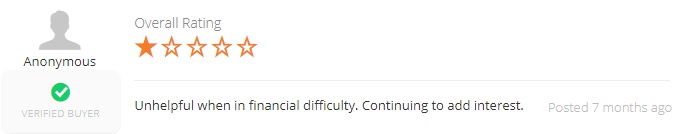

Negative reviews are also available on the website. The last negative review was posted 7 months ago. The user considers Cash Float unhelpful when in financial difficulty. No further details were provided. The online lender takes time to answer all negative and some positive comments, which is appreciated:

Negative reviews are also available on the website. The last negative review was posted 7 months ago. The user considers Cash Float unhelpful when in financial difficulty. No further details were provided. The online lender takes time to answer all negative and some positive comments, which is appreciated:

Read more reviews: https://www.reviews.co.uk/company-reviews/store/cashfloat.

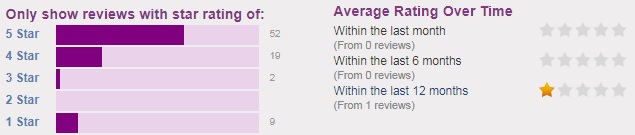

www.reviewcentre.com contained 82 reviews about the lender: 52 – with a 5 star rating, 19 – with a 4 star rating, 2 – with a 3 star rating and 9 – with a 1 star rating:

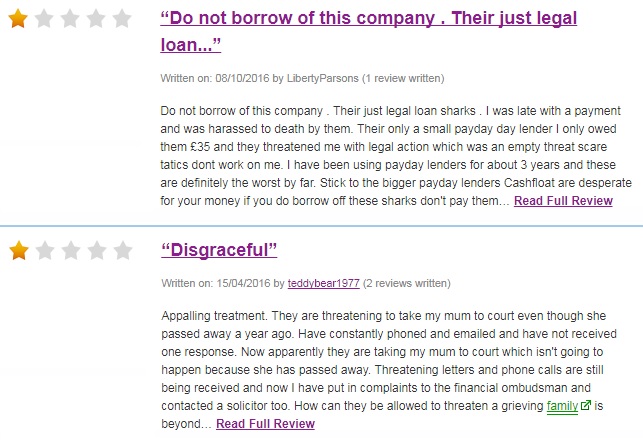

We were upset on discovering that there are no 2017 reviews about the company, and almost all 2016 reviews are mostly negative. The clients advised not borrowing from this company. One client was threatened with legal action when he was late with his payment. One more user complained of the same thing: the company threatened him, called and sent emails (but how is the lender supposed to behave when the client violated the loan repayment schedule?):

Considering these Cash Float complains, we may suggest that clients can have problems with this lender only in the case they make a late payment without prior informing, though the company asked to do so. See other Cash Float comments on http://www.reviewcentre.com/Payday-Loans/CashFloat-www-cashfloat-co-uk-reviews_2571622.

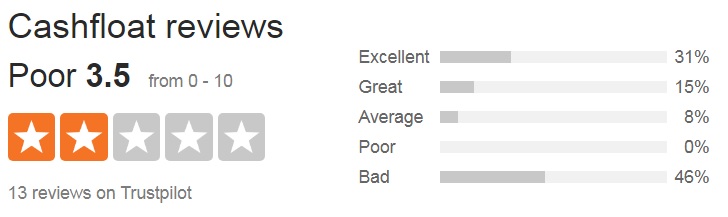

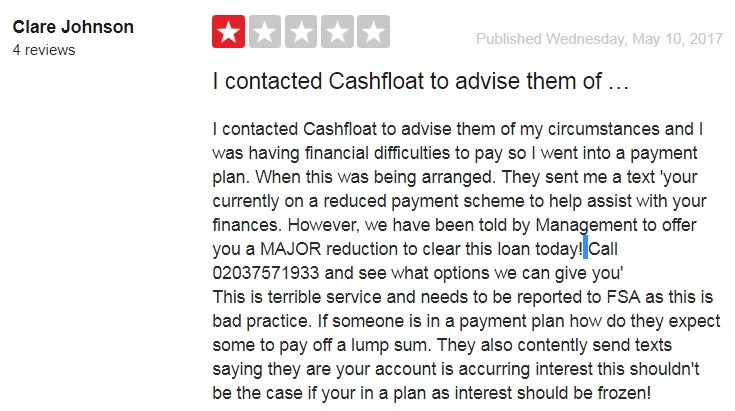

The third website which contained Cash Float reviews was Trustpilot.com. 2015 comments are mostly positive, while 2016 and 2017 reviews are purely negative, which is an alarming signal. It turned out that the website contained 13 reviews about the lender, and the company has a total score of 3,5 stars out of 10 on Trustpilot.com:

The last review was dated May, 2017 and it was negative. The client said he had a scheduled loan payment plan at Cash Float but before the due date the company asked him to clear his loan immediately. No reason was explained:

Read other Cash Float 12 reviews on https://www.trustpilot.com/review/cashfloat.co.uk.

So, it looks quite strange that the company has a perfect reputation ONLY on the website which was advertised by the company itself. All other comments indicate that the company used to provide good services in 2015 but its quality got worse in 2016 and 2017. Since there are many negative reviews on the net, we may suggest that customer may have some problems with the lender.

Contact Us section

Cashfloat Contact Information

The company has provided a comprehensive contact information. They head office is based in a London, 2a Highfield Avenue, NW11 9ET. Their email is [email protected]. The phone number are also indicated on the website:

Cash Float opening times are also available on the website. The company confirms its legitimacy with Company Registration Number 7581337, FCA full permission license 714479 and ICO Registration Number Z3305234. However, the company does not mention the year when it has started the business, and this information is very important to customers.

Locations

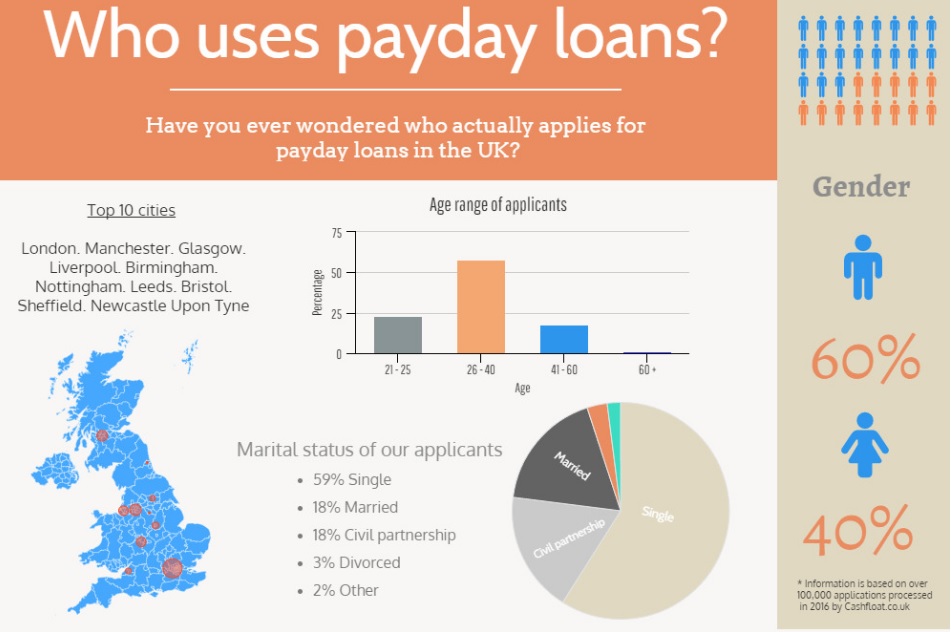

Cashfloat is available all across the UK, but some cities use its services most often. These are London, Liverpool, Manchester, Glasgow, Birmingham, Nottingham, Leeds, Bristol, Sheffield, Newcastle Upon Tyne. The company provided an infographic with some more interesting statistics customers would be curious to know about:

Customer Support Service

Cashfloat offices are open from 9:00 am to 5:30 pm Monday to Friday, during which the customer support team is ready to help clients with applications, repayments, and other queries. Customers can feel free to send them an email at [email protected] and they will respond within 24 hours (on business days). You can also call the company at 020 3757 1933.

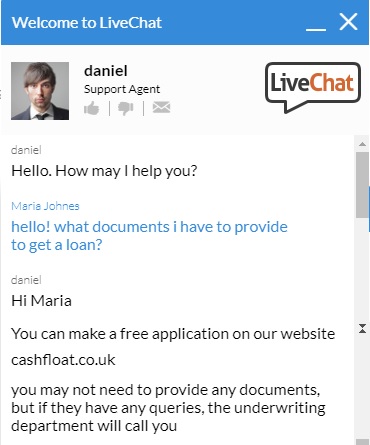

Customers are also encouraged to try Cashfloat Live Chat where they can get answers to any questions quickly.

The company mentions that it cares about every its customer, so they take all complaints seriously. If clients need to tell the lender about something they are not satisfied with, they can contact send an email at [email protected], and the lender will resolve their issue as soon as possible.

We decided to use the most quick and convenient way of contacting the company – a Live Chat. The question we were interested at is whether clients need to provide any documents when applying for a loan. Fortunately, the Live Chat was active and the company’s representative answered in a few seconds. It turned out the applicants do not need to provide any documents, however, the lender may ask them to do this, if necessary:

Obviously, Cashfloat customer support service is organized perfectly. Customers could not ask for more.

Conclusion

Cashfloat.co.uk is an online service which has many advantages: its availability all across the UK, various loan decisions, application forms are quick and easy, the company has a license, a very high rating according to ScamAdviser, a very informative website, a Live Chat can easily resolve any questions, the website uses a good encryption level which keeps the users’ personal data safe, there are flexible repayments, early repayment is possible any time. However, recent Cashfloat negative reviews 2017 undermined the company’s credibility to some extent. But we can’t 100% rely on these reviews as most of these unhappy users violated the payment schedule and that was their fault that Cash Float was annoying them. We can conclude that customers will most likely have a positive experience with this website ONLY ON A CONDITION they are able to repay their loans on time or at least will not forget to inform the lender about their inability to pay on a due date.

Ready to Apply?

Ready to Apply?