Drafty.co.uk Self Presentation

Drafty.co.uk is a financial organization that grants short-term micro-loans to people ignored by traditional lending companies. Drafty.co.uk runs its activity approximately since 2016, according to data is was registered on FCA. This is a trade name for Lending Stream LLC, which is registered in England. The company was founded by several frighteningly bright financial nerds to provide people with poor credit history but not a terrible one.

Drafty.co.uk is a financial organization that grants short-term micro-loans to people ignored by traditional lending companies. Drafty.co.uk runs its activity approximately since 2016, according to data is was registered on FCA. This is a trade name for Lending Stream LLC, which is registered in England. The company was founded by several frighteningly bright financial nerds to provide people with poor credit history but not a terrible one.

There is no information on the website which regions it works in, so it is possible to assume that on the whole territory of the UK. The company grants money without guarantors and references, which makes it popular among a lot of people.

| Type of loan | Min amount | Max amount | Interest rate | Terms | Documents required | Bad credit history |

| credit line | £50 | £3000 (£5000) | 0.18% | unlimited | none | yes |

Types of Loans

Drafty.co.uk offers only one type за loans – credit line. This type is better than simple payday loans. With credit line you can take any amount of money for any period of time, repaying minimal amount every month with APR. You may be approved for a bigger amount of money, which you may not use and leave on your account. If after some time the company finds your account in good condition the maximum amount may be increased for you.

Money are transferred on your bank account during 15 minutes from final approval Express Cash Transfer option for free if supported by your bank. If not, the procedure may take longer as the company claims. There are no additional fees from the company for a loan, except for APR. The company doesn’t offer fixed loans under 60 days.

All information concerning credit line description and details about its acquisition can be found in the «FAQ» section.

Terms of Use

Drafty.co.uk provides loans from £50 to £3000. The company conducts personalized reviews of your account from time to time. If the account is in good standing and you meet affordability requirements, then your limit may be increased to £5000. Daily interest rate is 0.18%. Cost of your credit line will depend on amount and term for which you take a loan. You can also pay early at no additional cost. This can help you save money by reducing interest charges. All information about fees and charges you can find at their «Pricing» page.

There is no limit for period you take your loan for. You may pay minimal amount each month for as long as you want until you pay off you loan completely. Credit line approved for you may be greater then you expected, but you do not have to use all of the money, just remember in future that you have extra money available if some emergency occur.

To be eligible to apply for a loan you must:

- be a UK resident;

- be at least 18 years of age;

- be in regular employment;

- have a monthly income of at least £1250;

- have a valid debit card;

- have an active bank account.

Unfortunately the company is unable to extend a credit line if you’re self-employed.

As you can see, unemployed customers can’t get a loan here, as they can’t prove their solvency. But there is no information that the company checks your credit history, so if you have poor one in you past and other lender rejected you, you have all chances to get a credit line here. Read all details about what is needed from you to get a loan in the «FAQ» section and contact you lender to get final details.

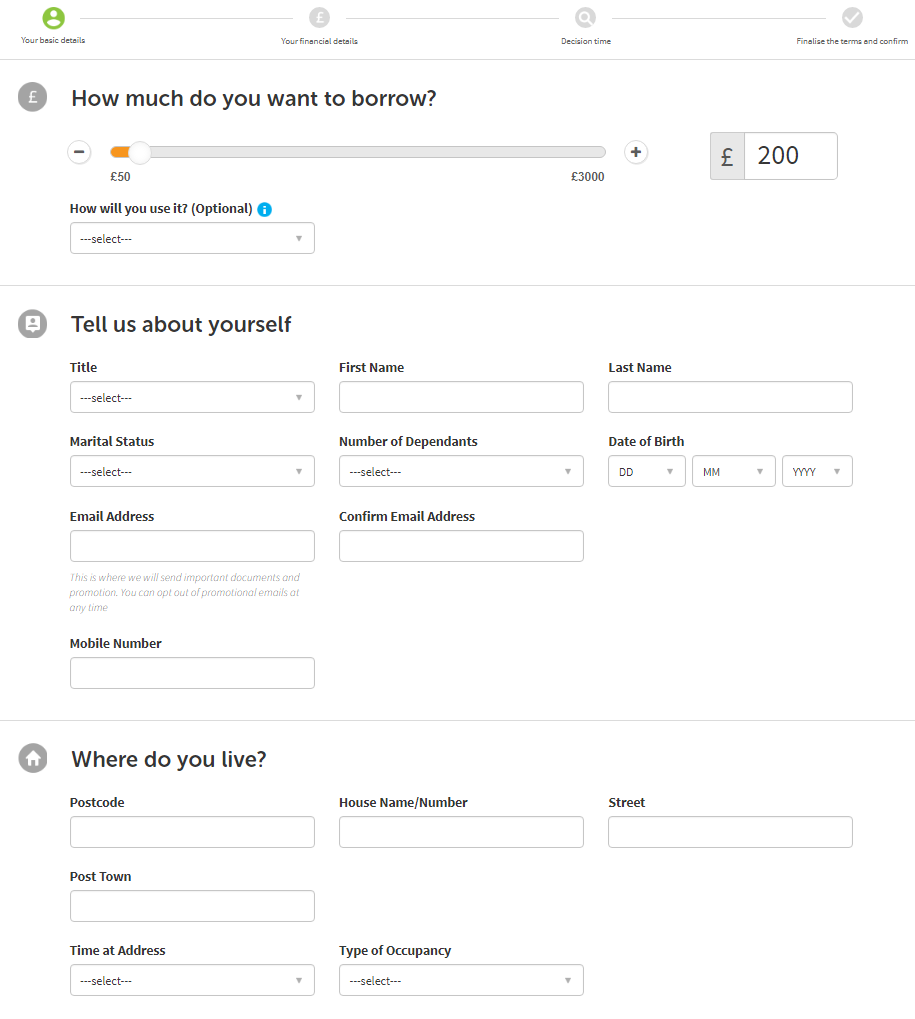

Application

On the website you can find information that customer are not asked to provide any references, but if there appear any troubles with you application the company can ask to verify some details by phone, fax or E-mail. There is no information about providing guarantors for taking a loan, but it can be concluded that no guarantors are needed, as you application is reviewed online.

Also there is no information about time required for reviewing your application. The process can take quite long, but money after final approval are transferred very fast – only 15 minutes (if your bank supports Express Cash Transfer). But this procedure can also take longer than claimed.

Repayment

Each month you are required to pay a minimum payment based on the amount of your credit line. The company will automatically withdraw payment from your bank account on the due date. You also have the right to cancel CPA at any time (automatic withdrawal); however after that you’ll need to arrange another way to make payments, such as self-service payments through your online Drafty account, standing bank order or posting a cheque.

If you would like to pay off additional amounts of your outstanding balance, you can do it in your account at any time and make a payment. Also you can pay off your credit early which will save you money in interest and will make overall cost of loan lower. If you know you won’t be able to make an upcoming payment – contact the company and they will figure out a plan that works for you.

There are no late fees, no application fees, no transaction fees, and no fees for paying your credit line off early. Drafty.co.uk has no hidden fees at all. If you find yourself contacted by a company or individual claiming to be Drafty asking for upfront fees or upfront payment of any kind, please read company’s «Caution Against Fraudsters».

Extension

Credit line is not like a payday loan. You don’t need to pay off the whole amount in 60 days. So you don’t need to take another loan after the first one is paid off, the money at your disposal for unlimited period. However if you want to get several credit lines, you probably won’t be able to do that.

Besides the company constantly provides reviews of the account and if you account is in good standing your credit line can be increased to £5000. This money will be at your disposal at any time, unless you want to decrease or close your credit line. In this case you will have to contact the company on the phone and ask to decrease or close it. They will be happy to help you and make their services as comfortable as possible.

Drafty.co.uk Bad Credit History

The company was created to help people with not perfect credit history get loan for their emergencies. It is widely known that bank are not loyal to customer with some problems in the past or to those trying to get small amounts for a short time. Drafty.co.uk is the place where you can go and be sure to get financial help. The company only checks your solvency at the moment, not requiring any documents.

According to information you provide to them, you are granted a loan which you can afford to repay. If you meet all the requirement for applying for a loan, you can be sure to get money. However if your credit history is extremely bad, chances are low, as the company still need proof that you will repay money granted to you.

In case your credit line is repaid in time with no troubles, the company can increase your credit line and your credit history will be improved in future. So the best way to make your history positive is to take a loan at Drafty.co.uk and pay it off on time.

Technical Data of Drafty.co.uk

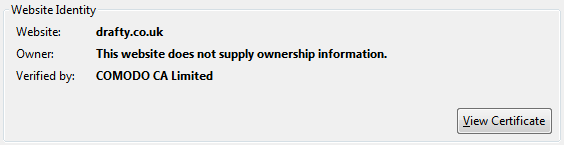

Secure Connection

To provide safe services in the Internet most websites use special secure connection to protect users’ data from theft and unauthorized access. Before creating account, applying for loan or just giving any information about yourself, check the website for security. To do this just look at the address bar, if you see «https://» instead of «http://» and a green lock, than you can be calm about your data security.![]()

If you strongly concerned about your sensitive data and you want to get more details about level of security on the website, you can look at the certificate of security, which is available to any user in the Internet.

As we can see Drafty.co.uk provide 128-bit data encryption, which is not the highest level, but still – most websites do not provide any protection at all. Also information about certificate owner is hidden so we can’t checks reliability of this document. Unfortunately, this results are lower that it is expected but protection of users’ data is present, which is a good thing.

Mobile Version

The website has a very attractive mobile version. The website is not just adapted for mobile devices, all functions and interface are changed so that customers were comfortable using the website on their devices. The text is readable and attractively organized, pictures are clearly see, so there is no need for zooming. The applying procedure is also organized a little bit differently, for more convenient use on the mobile device. The test by special services shows us that the website is mobile-friendly.

However as the report shows, the website has some loading problems, which spoils overall impression about the mobile version. There were several resources that were not loaded by google. But in general the version is great and with few corrections will get the highest score.

Antivirus

There is no information or icon showing that the website has antivirus protection. This means that customer visiting this website are not secured from any malware. Those users that do not have antivirus on their own devices risk to get serious damage to their devices or get their data stolen by some hacker program. We would advice to get your own protection and check if the website you are using has it, before entrusting your data or downloading anything from it to your device.

Convenience of Application

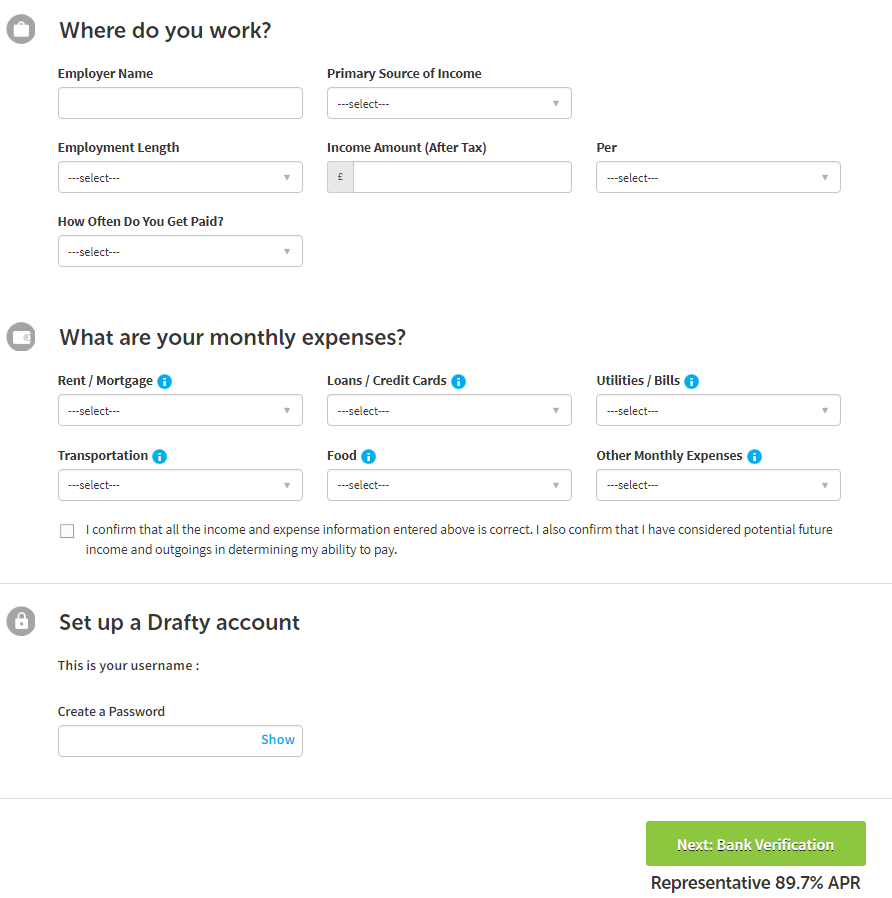

Applying for a credit line at Drafty.com.uk is very simply and doesn’t take a lot of time. There is no need to provide any documents or references. On the main page, as well as on most other pages you get find a button by clicking which you will be directed to the application page.

There you need to choose amount of money you want to get and provide information about yourself, your job, income and monthly expenses. By the way, during application your account is created automatically, so there is no need to register before applying.

After you give all above details you need to provide your bank account details, and that’s it. You only need to wait for a decision and if approved get you money in 15 minutes on your account.

Unfortunately, the company doesn’t give any information about how long it will take to get decision on your application, so it can take quite a lot of time, since period is not determined. Just be ready to wait for some hours or days, just in case.

In general application takes about 10 minutes only to fill it in, but waiting can take much more time. Still the process is easy and doesn’t require any additional action on your side.

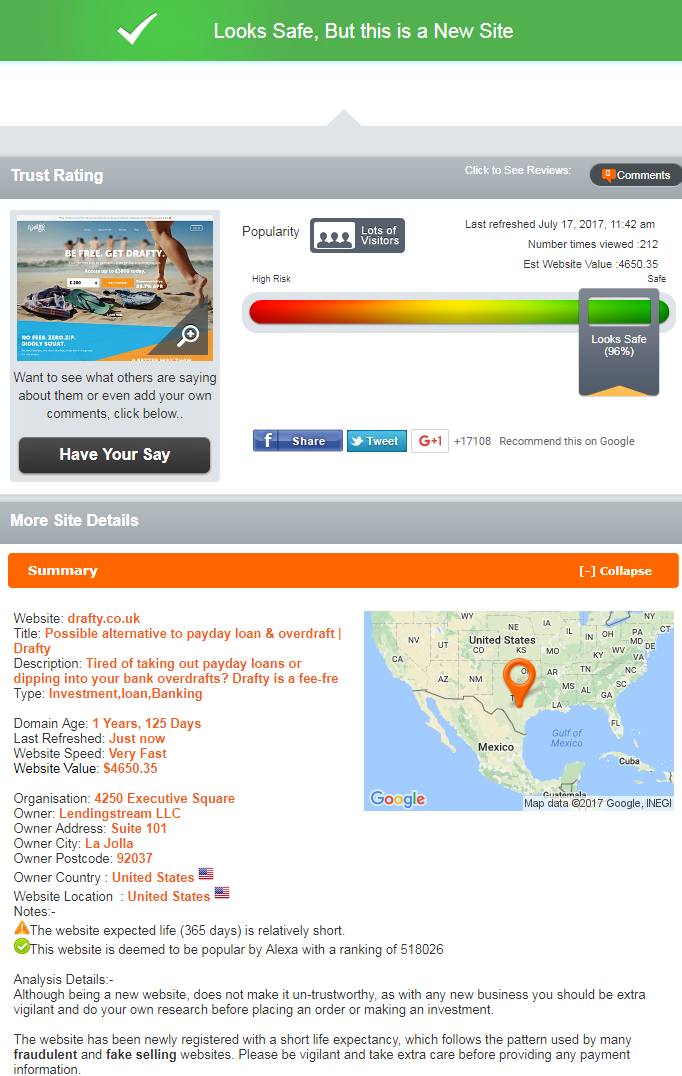

Is Drafty.co.uk Legit?

According to ScamAdviser.com the website have a very good rating. Its reliability level is very high, but ScamAdviser warns you that Drafty.co.uk is a new website, so be cautious. However, the website has lots of visitors and no negative comments, safety rating is 96%! The report looks very optimistic but there one thing that is confusing.

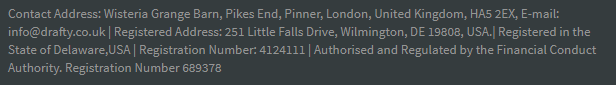

We know that this website grants money only to UK residents, and that the company is UK based. Even the domain name tells us that is it from UK. But the location and owner address are in the US. And ScamAdviser.com doesn’t notice this. Probably because the company never claimed to be UK based. We can propose, that the company itself is in England but it uses services of the website located in the US. Still this situation is strange and inspires different suspicions and thoughts.

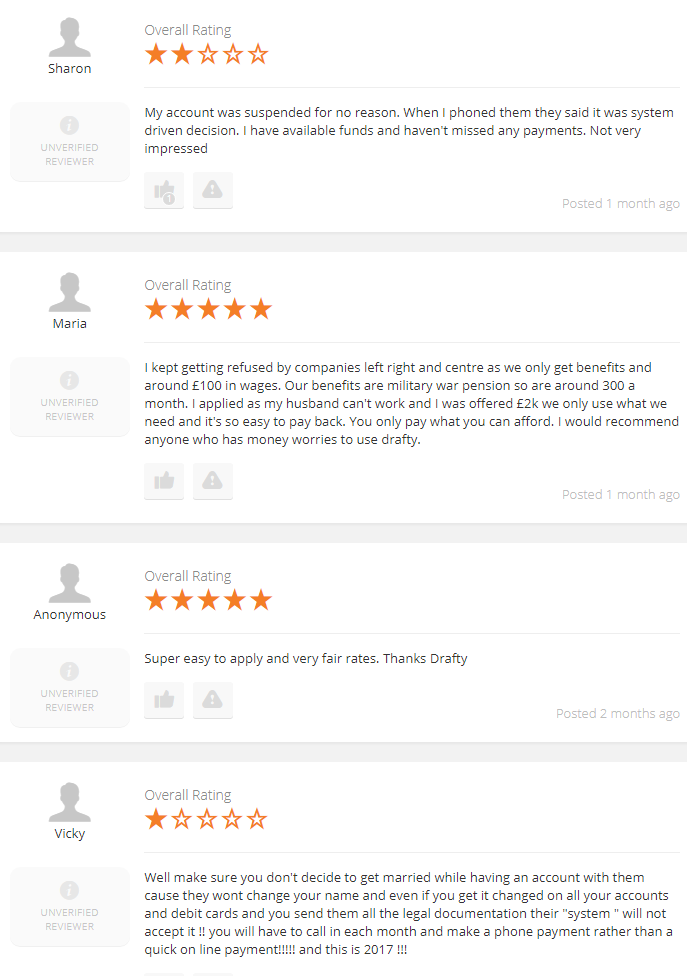

Drafty.co.uk Reviews

Reviews on the Website

On the website in the bottom of the main page customers can find some comments of other customers about Drafty.co.uk. But it turns out that there is no special page with customers reviews on the website. There is a link to a special website www.drafty.reviews.co.uk created by the website for customers testimonials. But this website is considered as a third party resource, so in fact the company doesn’t have its own page with testimonials on this website.

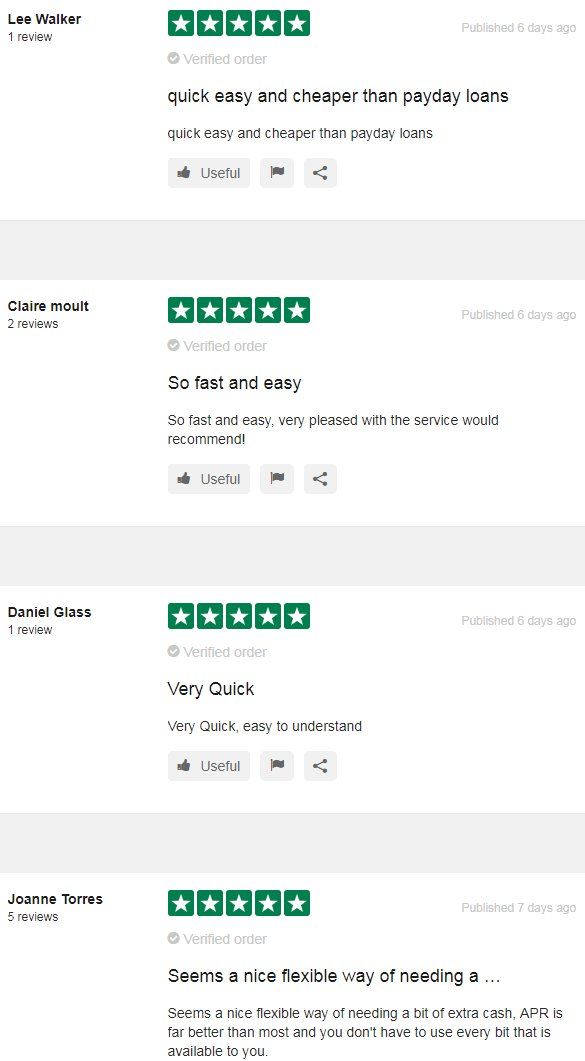

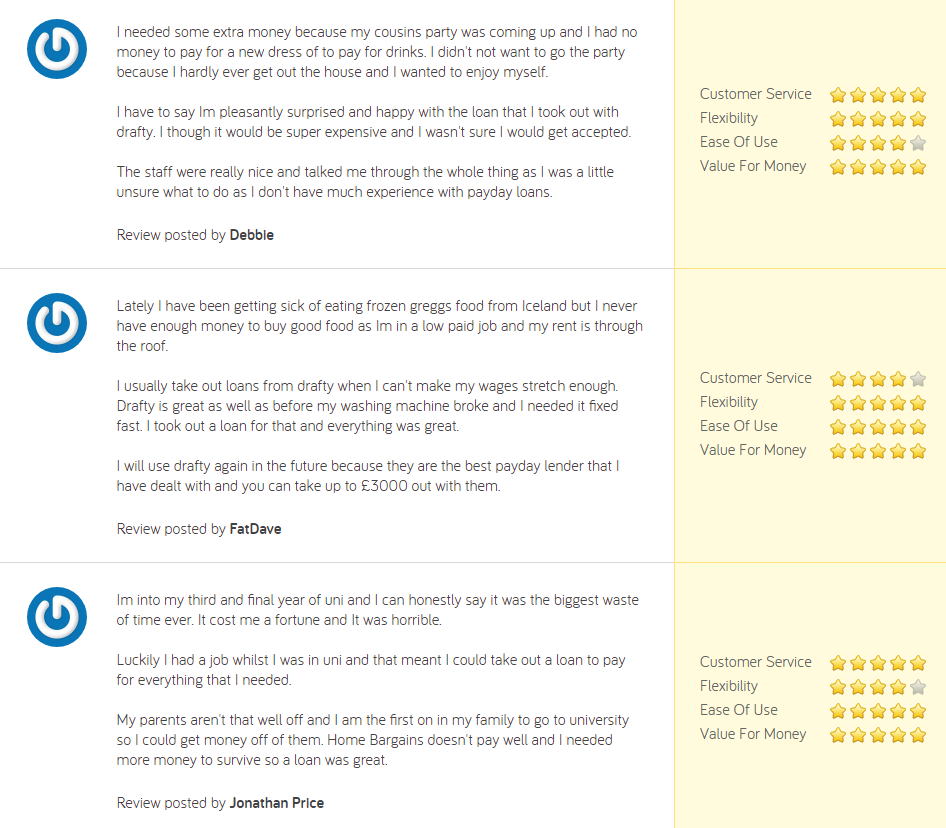

Reviews are mainly positive and there is a large number of them – about 300. According to these testimonials the company have 4.79 stars rating. There are some negative comments, but they are very few. In general the company is reviewed by customers as reliable and safe service with good performance. Application here is easy and quick, so many people appreciated the service.

Reviews on Foreign Resources

We search through the Internet for other websites and forums with customers reviews about Drafty.co.uk. And we have found several resources with comments on them. First of all, TrustPilot.com has a lot of reviews and gives the company a very high rating basing on these comments and customers estimations – 9 stars out of 10. This resource is very reliable and popular, so there is no reason to double originality of the comments.

There are mostly positive reviews, though there are some negative. Some customers faced very unpleasant situation with freezing their account or non-approval of their applications. But we have to understand that there may appear some technical issues on the website with your account and customers with very bad credit history can be declined. It is said on the website that they grant money to people with not ideal credit history but not terrible.

Anther resource we found seems not very reliable. There is statement that there are 12 comments about the company, but in fact you can see only three and there is no information or link to find the rest ones. These comments are all very positive with high rating, so the company gets 4.8 out of 5 stars on this website. This rating is exactly the same as on their own website with testimonials. This may be a coincidence, but still causes suspicion.

Customers Support on Drafty.co.uk

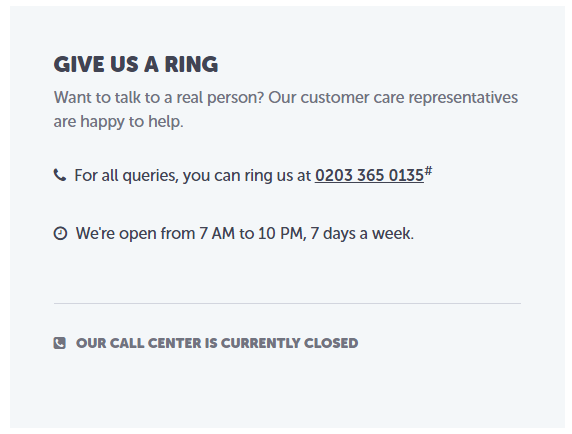

«Contact Us»

On the website there is a special section with contact details. Here you may find the phone number of the support group, hours of operating and current status of the support group availability (open/closed). Also here you will find contact form to contact the support group by e-mail. On this page there is no mailing address, so you are encouraged to call or write e-mails to the company.

Contact address is given in the footer on each page, with registered address, e-mail and other information. These addresses don’t coincide with the one indicated in the report by ScamAdviser.com. A very strange thing can be noticed – contact address is in the UK and registered address is in the US.

In general all necessary information is provided to the customer, but it is presented not on one page, and customers will have to look for it on the website by themselves.

Support Group Service

There is no live chat option to get instant answers to our questions and have a real time live dialog with managers of the support group. To get consultation you need to call their call-center of send contact form, which is presented on their website.

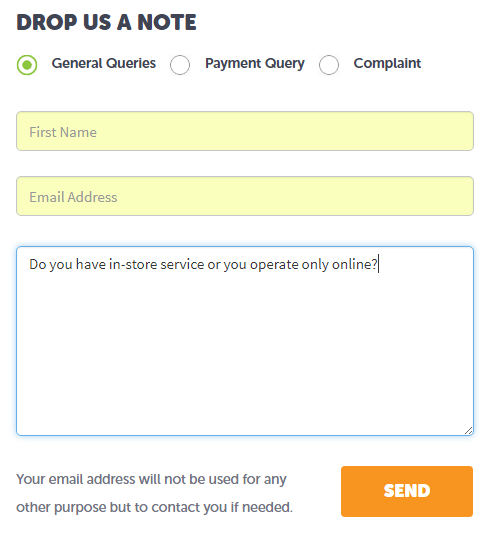

So we decided to ask the support group about in-store services, as for some people it is more convenient to get money in the office instantly. We filled in contact form and send our inquiry. It should be noted that the company doesn’t require your phone number or any personal information except for your e-mail, to answer your message.

After sending this request we immediately got an automated message saying that we will get answer within 2 business days. This is a very long period for waiting and such work can’t be called effective in no case. Customers can’t get necessary information during 24 hours and will have to use another service. So we recommend the company to improve customers service as soon as possible.

Conclusion

Summing up everything stated above it can be said that Drafty.co.uk is quite a reliable service. Most customers are very happy with the company work and are willing to continue using their services. Reviews on the special website from the company itself and on other resources show a very attractive picture of company reputation – all ratings are very high. Besides check out for legitimacy also gives the company a very high status.

The process of application is easy and quick, money issued within minutes. The website is very informative and contains all information that can be necessary for customers to make a decision in favor of the company. There are no hidden difficulties and no fees for service itself. So in general Drafty.co.uk can be recommended to customers as safe and credible service, though performance of the support group must be improved.

Ready to Apply?

Ready to Apply?