Loans Canada Online Self-Introduction

Loans Canada Online (loanscanadaonline.com) is comprised of a group of lenders who is able to accept your application for a loan online. This website provides faster and secure access to payday loans within the territory of Canada. Loans Canada Online is present in the following provinces:

![]() All you need to do is fill in one simple hassle-free application online! Loans Canada Online makes sure that you get:

All you need to do is fill in one simple hassle-free application online! Loans Canada Online makes sure that you get:

- the most flexible loan repayment options;

- low interest;

- no hidden fees;

- hassle-free cash application process.

| Types of Loans | Min Loan Amount | Max Loan Amount | Period | Interest Rates | Documents | Bad Credit History |

| payday loans | $ 100 | $ 1 500 | agreed individually | agreed individually |

| YES |

Types of Loans

Loans Canada Online provides clients with one type of loan – payday loans. The money is deposited into your bank account by electronic transfer usually within 24 hours after being approved. There is no other way to get money because Loanscanadaonline.com is an online institution only.

Loans Canada Online administration doesn’t require you to inform the reason for which you need money. You are welcome to spend them how you want but remember to pay a loan back in time.

Terms of Use

To take a loan from Loans Canada Online you have to meet the following requirements:

- you are a Canada resident;

- you are older than 18 years old;

- the evidence of identity is required;

- evidence of income and work;

- have an account in the bank.

People under 18 years old are not eligible to take a loan from this online service. Clients should provide Loans Canada Online with identity evidence proving that you are of full age.

Loan amount available on Loans Canada Online is from $ 100 to $ 1 500. The lender will itself decide, when processing your application, how much you can qualify for. After successful loan repayment, your loan amount may increase on any future loans.

![]()

The period during which you have to pay a loan back and interest rates are determined individually depending on the sum of money you are eligible for. So that, a lender will inform you about all details after being approved.

Clients having no constant working place with the steady income cannot have an opportunity to take a loan from Loans Canada Online. A lender should see client’s solvency. If you cannot prove your paying capacity you won’t be eligible to be approved.

Application

Loans Canada Online, as many other online lenders, doesn’t require to fax or send any kind of documents to them but you should provide the following information:

- personal information (ID Number);

- employment information;

- banking information.

There is no strict requirement to ensure guarantees or contact persons. You have to prove your own income and it will satisfy the lender to approve your application for a loan online. If a client seems to be suspicious, any guarantees will help you be approved.

To apply for a loan, it is necessary to complete and submit the application found on Loans Canada Online website. To fill in the application itself takes just a couple of minutes. In most cases, the application is processed and approved instantly.

Loans Repayment on Loans Canada Online

There is no actual information about how a client should pay a loan back. As it is mentioned above, Loans Canada Online is not a direct lender that’s why all the details should be discussed with a lender you are taking a loan from.

As usual, a client’s next payday will be repayment date for borrowed cash. But you can stretch the loan repayment for a month also. There is no collateral involved in these unsecured loans. Delay in payment is a universal method to cope with the problem when you cannot pay a loan back on your due date but Loans Canada Online provides no such an opportunity according to Canadian regulations. This is a confusing information. in one case it is possible to stretch a loan for a month, in the other – absolutely impossible. It is better for Loans Canada Online to make up its mind carefully.

There is no concrete picture of what will happen if a client misses a due date. If Loans Canada Online doesn’t transfer your loan case to collateral organizations, how they, in this case, are going to get money borrowed is unknown.

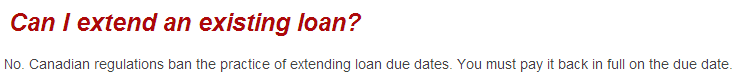

Extension

As it is written on “About Payday Loans” page, clients have no right to extend the loan according to Canadian regulations.

But we find an information that Loans Canada Online may stretch your loan for a month. We do not know how to estimate this information but in general, we believe that it is possible to cope with due date questionable issues if you contact with the lender. You both will try to find the way out because it is an affordable deal for both parties.

Loans Canada Online is comprised of a group of lenders that’s why it is reasonable that all controversial points should be discussed with your direct lender.

But it is clearly known that it is impossible to take a loan if you have not paid a previous one back completely. This online lender administration points out that only after you have paid a loan back, you are able to take a new one and loan amount available in your exact case will be increased if the payment is successful without missing and delay.

LoansCanadaOnline.com Bad Credit History

Bad credit history is not an obstacle for LoansCanadaOnline.com administration if you take a loan in Ontario, Canada. If a client is able to confirm his solvency, everything becomes possible.

![]()

Most people may have a dream to start their own business, but bad credit prevents them from taking a small business loan. If you have an opportunity at hand, and just need a little bit of money to start it, you may have a desire to file for applying for payday loans in Ontario where bad credit won’t matter, and you may be on your way to owning your own business.

![]()

It does not even matter if a client has a positive or negative credit score. Loans Canada Online will ensure a client with a trustworthy and reliable cash loan lender in Canada. If you desire to take a loan or get more information, you may come in contact with this online lender.

Technical Data

Secure Connection on LoansCanadaOnline.com

Unfortunately, Loans Canada Online is asleep at the switch to protect client’s personal data. They do not provide any opportunity for clients to be sure their connections and transactions are absolutely secure. LoansCanadaOnline.com doesn’t use any kind of encryption to prevent hackers from unlegalized access. There is no information about company owner and security certificate is not verified.

![]()

Clients when filling in an application form online, enter their personal data or banking information which should be carefully encrypted. If a client suspects Loans Canada Online in personal data disclosure, they may address to court to get compensation.

Mobile Version of LoansCanadaOnline.com

A user-friendly mobile version is a universal way to apply for a loan if you come across with financial troubles. Loans Canada Online makes everything possible to provide clients with all means for convenient service.

Mobile version of LoansCanadaOnline.com is universal because it is adjusted to different mobile devices simplifying the application enrollment. Everything becomes more convenient if you have a smartphone within reach and is ready to apply for a loan in case of financial troubles.

Mobile version of LoansCanadaOnline.com is universal because it is adjusted to different mobile devices simplifying the application enrollment. Everything becomes more convenient if you have a smartphone within reach and is ready to apply for a loan in case of financial troubles.

Antivirus Presence

There is no antivirus on loanscanadaonline.com that’s why computers and mobile devices are at risk zone. The rate to “catch” viruses or other online threats become higher and higher. Loans Canada Online administration should think properly and install an antivirus to protect clients from unwanted circumstances.

Convenience of Application

To leave an application takes even 5 minutes to be filled in. To find the application form it is necessary to press the button “Apply Now” or “Get Your Cash Now”, which there is not only on front-page but on other websites pages as well.

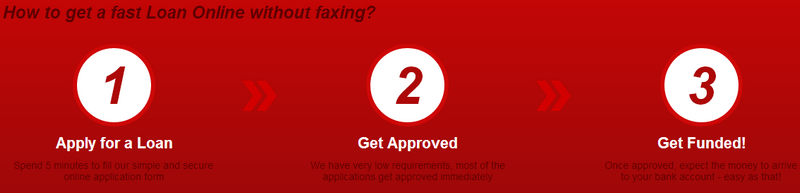

There is three steps on Loans Canada Online which will help a client get cash:

There is three steps on Loans Canada Online which will help a client get cash:

But if speaking about application there are also three main steps which are mandatory for filing in:

But if speaking about application there are also three main steps which are mandatory for filing in:

- personal information;

- employment information;

- banking information.

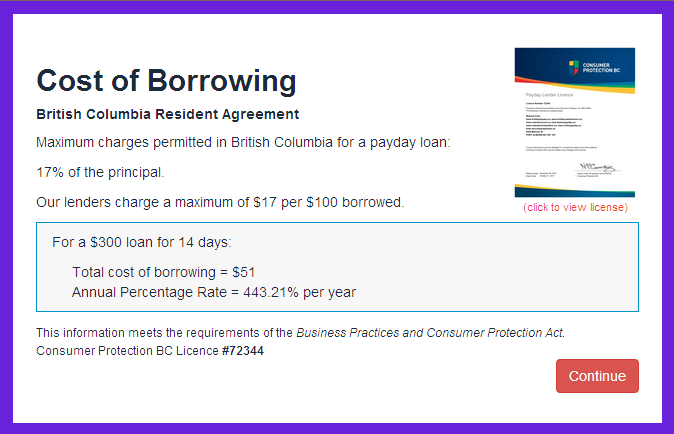

In general, the application form is convenient and simple. It may be filled in by people of different ages. When choosing a province you are living in you will see the following banner:

You will grapple with the main aspects of interest rates and periods for borrowing. You will be able to get acquainted with the license of Loans Canada Online and other lenders in this financial group. But this information is presented in the period when you are in process of application enrollment. But if you have a desire to get to know it beforehand you will fail. It is rather inconvenient.

Everything left is acceptable and may be used fast. Clients are able to undergo three main steps in 5 minutes and wait for an approval.

Is LoansCanadaOnline.com Legit and Safe?

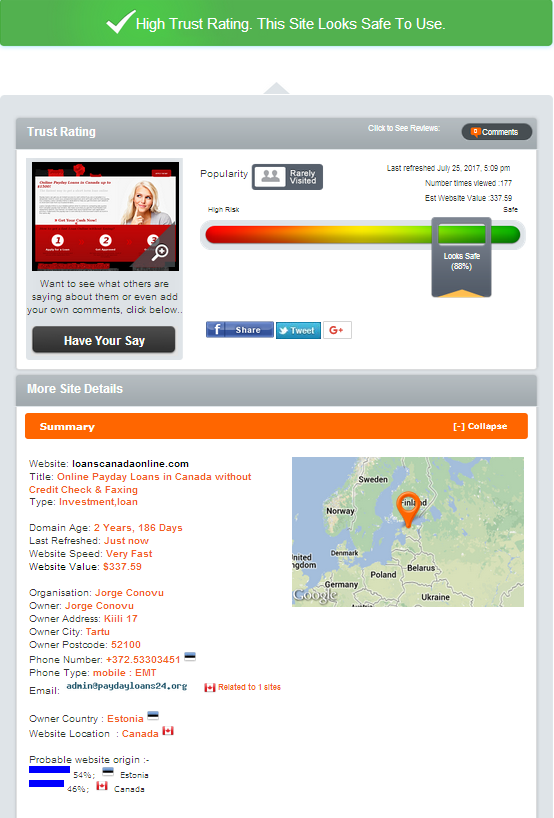

ScamAdviser.com believes that this online service has 88-% of security. It also considers Loans Canada Online as high trust rating website but we have found a lot of inaccuracies. For example, ScamAdviser.com defines company location and telephone number is Estonia but we remember that this service is a Canadian one.

Website location is Canada, Toronto (as it is pointed out in “Contact Us” on loanscanadaonline.com) but it seems odd that company owner and the website itself are situated in two different areas. Organization name (founder) is Jorge Conovu.

Website location is Canada, Toronto (as it is pointed out in “Contact Us” on loanscanadaonline.com) but it seems odd that company owner and the website itself are situated in two different areas. Organization name (founder) is Jorge Conovu.

Domain age is 2 years 186 days and during all this period of existence, it is considered to be rarely visited. It means that this online financial service cannot be estimated fairly. Moreover, there are 33 websites involved in the activity of this server. It may be a sign of illegal business where main victims are clients. All these 33 websites have the same specialization as loanscanadaonline.com, exactly speedy payday loans.

So that, we cannot have an idea, a logic idea why loanscanadaonline.com has such a high trust rating – 88-%. Clients should be attentive and analyze all the information before applying for a loan.

Reviews about Loans Canada Online

Reviews on LoansCanadaOnline.com

There is no separate page with reviews left describing LoansCanadaOnline.com performance. There are reviews on front-page with clients who are absolutely satisfied with the work done. But we have some doubts about how these reviews appear on LoansCanadaOnline.com. There is no feedback form by means of which clients are able to leave a review. As we mention above all the reviews are positive and left by people living in Canadian provinces in which there is no representative office – Quebec or Montreal.

All the reviews are left in the unknown date that’s why we cannot estimate when they were left. For this period of time, everything may change considerably.

There are only 4 reviews on Loans Canada Online and we have a suspicion they were written by site administration to make clients sure that the number of satisfied customers is enormous.

Reviews about Loans Canada Online Left on Third Parties Recourses

Surfing the Internet, we have failed to find any evidence of reviews relating to Loans Canada Online performance. The fact given by ScamAdviser.com was proved that loanscanadaonline.com is rarely visited online service. It is very odd that clients have no desire to share their opinion to help people

Surfing the Internet, we have failed to find any evidence of reviews relating to Loans Canada Online performance. The fact given by ScamAdviser.com was proved that loanscanadaonline.com is rarely visited online service. It is very odd that clients have no desire to share their opinion to help people

Nowadays there is such a tendency that people strive to share their opinion that’s why it looks suspicious that there are reviews on the Internet speaking for or against LoansCanadaOnline.com.

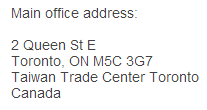

“Contact Us” Information

“Contact Us” Section

Loans Canada Online offers clients to get to know main office address located in Toronto, Canada. But unfortunately, there is no telephone number by means of which clients are able to come in contact with site administration or support group. We remember that ScamAdviser.com doesn’t hesitate about website locate but there is some inaccuracy with company owner location – Estonia.

It is strange that they provide no contact telephone number because there are cases when a client has only one opportunity to contact a support group – over the phone.

It is strange that they provide no contact telephone number because there are cases when a client has only one opportunity to contact a support group – over the phone.

Locations

The main popular provinces for Loans Canada Online presentation are:

- Ontario;

- Edmonton;

- Toronto;

- Calgary;

- Winnipeg;

- Vancouver.

But there is no acute information relating to payday loans in Winnipeg and Vancouver. But comprehensive information is given to other provinces in which people may take a loan having some specifications.

| Ontario | Edmonton | Toronto | Calgary |

| up to $1,500 | up to $1,500 | up to $1,500 | up to $1,500 |

| approval immediately | approval within 15 min | approval within an hour | approval within 15 min |

| from 18 | from 18 | from 18 | from 18 |

| bad credit history: YES | bad credit history: Unknown | bad credit history: YES | bad credit history: Unknown |

Customer Support Service

There is no live chat on Loanscanadaonline.com but contact form is present. It implies that clients will be able to contact customer support group by means of it.

But we do not understand the principle of its operation. We fill in the mandatory fields, ask the question relating to penalties and do not understand whether the form was submitted or not. There was not any sign that the request was sent to customer support service. We do not get any automatic message informing us that they will answer us as fast as possible. Loans Canada Online support group doesn’t take all the efforts to help clients solve their problems.

Conclusion: Loans Canada Online – Uncertain Online Credit Institution

Loans Canada Online is comprised of a group of lenders providing clients an opportunity to take a loan in an amount from $ 100 to $ 1 500. Periods and interest rates are agreed individually. It is a logic question whether loanscanadaonline.com is safe and legit. We try to ensure you with information necessary for being sure this online service is what you exactly need to cope with your financial troubles.

But we come across with the list of inaccuracies and inconveniences which prevent us from recommending Loans Canada Online.

- The first inconvenience is that according to Canadian regulation it is banned to extend the loan but Loans Canada Online staff points out it is possible to stretch the loan for one month.

- The second inconvenience is that a client is not able to grapple with reviews left in the Internet on third parties recourses. Reviews which are left on Loans Canada Online seem to be dreamt up.

- The third inconvenience is that clients have no right to leave a review on loanscanadaonline.com itself.

- The forth inaccuracy is contradictory information given by ScamAdviser.com. The rating is high – 88% but so many strange stuff which cannot help people to decide to command Loans Canada Online service.

In general, we cannot recommend loanscanadaonline.com as a reliable online institution. We advise clients to get acquainted with all possible details given on the website itself and third parties recourses.

Ready to Apply?

Ready to Apply?