What is Northcash?

Northcash is a direct lender that offers installment loans online. This website is owned the Fort Belknap Indian Community, an Indian tribe located in Montana, which means that Northcash is not subject to suit by a customer or any third-party for any reason. The website is OLA-sealed, which means that this website works legally, in accordance with the high-quality standards federal laws and protects its clients from fraud.

| Loan types | Min.amount | Max.amount | Period | APR | Documents | Bad credit |

| Installment loans | $300 | $1,500 | 3-18 months | 716% – 795% | Social Security number, Driver License No. | Possible |

Types of NorthCash loans

Northcash installment loans (also known as personal loans) are designed to provide customers with a relatively small amount of money for solving short-term financial problems such as debt repayment, paying utility bills, buying inexpensive goods, paying medical bills and college fees. Installment loans are quite expensive and are not intended for solving long-term financial problems.

The lender explains the difference between different personal loans available:

- Unsecured loans are those loans that don’t require that any collateral (such as property or possessions). For such loans, you need to have a good credit history and a steady income reaching the definite amount of money. Interest rates for unsecured loans are high since the lender takes a definite risk issuing loans to a customer. An installment loan is the most common type of unsecured loans;

- Secured loans are those loans that require a collateral (assets, property, possessions such as a home, a car, and others). The exact collateral will be stated in the loan contract. Failure to repay the loan can result in losing your property;

- Opened-end loans are those loans that can be borrowed on an ongoing basis;

- Closed-end loans are those loans that cannot be borrowed again. Most popular loans from this category are car loans.

North cash loans are usually deposited directly into a customer’s account the next business day through Automatic Clearing House (ACH).

Terms of Use

To get a loan through northcash.com, you need to meet the following criteria:

- Be at least 18 years of age;

- Legally reside in the United States;

- Do NOT reside in the states in which North cash services are not available (states are mentioned in unit 5.2);

- Be not a member of the military or his spouse;

- Have a source of regular income;

- Have an active ACH accessible checking account.

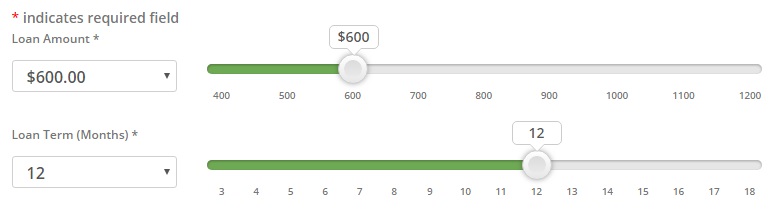

Northcash loans range from $300 to $1,500.The approved loan amount will depend on the personal information you provide in an online application, credit score, and your history, if loan repayment.

The lender’s maximum APR is 795%, and its lowest APR is 716%. The interest rate will depend on the loan terms.

Application

At NorthCash.com, you can fill out applications 24 hours a day 7 days a week. In general, it’s a 3-step process:

Fill out an easy online application. You will need to provide the following information: driver’s license/state ID, banking information, income information. The decision on the loan will be made quickly and the lender will inform you about the amount you are allowed to borrow. Then you need to finalize your loan with a specialist from Northcash Customer Care – for this, you need to call at 1-855-333-6570. Finally, the funds will be deposited into your banking account as soon as the next business day. NorthCash mentions that delivery exact times depend on the client’s bank.

In some cases, North Cash may request some additional information to approve your loan. The lender may ask you to send copies of your recent bank statements or other documents that prove your solvency.

Loan Repayment

Northcash loans are to repaid in approximately equal payments, but customers can also pay the loan early without penalty – for this, you need to contact Customer Care at least 3 days prior to the next payday. All payment terms will be described in detail in the contract and may vary between 3 months to 18 months. They will depend on the loan amount requested and a client’s ability to make monthly payments.

Customers can choose between two methods of loan repayment:

- Automatic money withdrawal from the client’s checking accounts each due date with the help of Automatic Clearing House (ACH). But if the client will not have enough funds in his account, he will be charged a $30 fee. If you delay the payment, you will also have to pay $30 late fee for each missed payment;

- Money Order, Certified Check or Cashiers Check to the specified address at least 5 days prior to the payment date.

Loan Extension

Nothing was mentioned about the possibility to extend a loan. Northcash only mentions that they provide only one loan at a time.

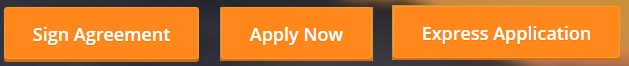

However, customers will be able to get a new loan as soon as he repays his previous loan amount in full. Return customers will have even simpler express application.

NorthCash.com Bad Credit

North Cash does not check clients’ credit ratings through the three major US credit reporting bureaus, however, the lender may use alternative credit reporting agencies such as Clarity, Factor Trust, DataX. The lender checks the credit history to be sure in the client’s ability to pay off a loan.

The company also mentions that it’s important to know your credit rating since it’s an important aspect of lending. North Cash offers several options to check your credit history. The lower your credit rating is, the fewer chances you have to be approved. And people with good credit score will have higher chances to get a loan. According to this lender, 700+ credit score is considered good.

Technical Characteristics of the Website

Checking Encryption

North Cash guarantees that all customers’ sensitive data are 100% secure. The website uses 128-bit encryption verified by Yandex LLC.

This may be enough to feel safe, however, I’d like to use websites with more advanced security measures.

Checking Mobile Version

The website has a mobile version which is adapted for various smartphones. Google confirmed that NorthCash.com is mobile-friendly.

The mobile version has an excellent compatibility with various mobile devices, all elements are correctly displayed on the smartphone, the mobile version has an improved navigation, its own design, and more convenient navigation. Using a mobile version allows you to load the site faster than, if necessary, you can return to the desktop version. I noticed no problems or bags.

Checking Antivirus

Websites like NorthCash.com must be 100% secure. Many large online lenders use antivirus programs to protect customers from viruses and malware programs. Regretfully, this lender does not use an antivirus on its website. I think it’s an important aspect of such business. So, you still have high chances that your computer will be infected with viruses.

Convenience of Using NorthCash.com

At this website, you do not need to register in order to start an application. You just need to type in your first name, last name, and email. The entire application process is online and over the phone.

New visitors should go to the Apply Now page and complete an application. When you press a “Submit” button, the lender will notify you whether you are approved or not within a few seconds. Returning customers may use an express application which will save their time when requesting a new loan.

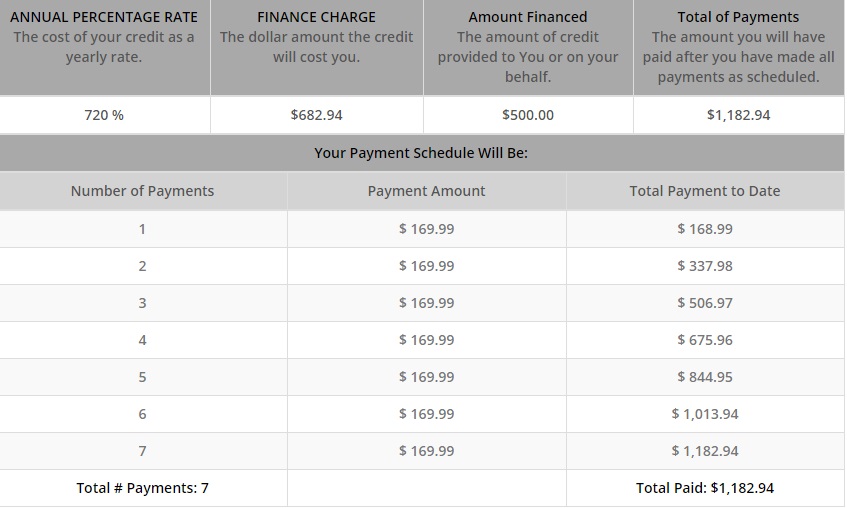

When necessary, customers may use a convenient loan calculator, which will help you define the exact amount to be repaid:

The lender specifies all loan terms and conditions in advance, the site is very informative. It has a full description of loan features and a detailed FAQ page. What I really appreciate is that the site has representative examples illustrating approximate interest rate and total payment details in a table.

Also, customers may log in to North Cash self-service at any time to check the loan status,

Is North Cash Legit?

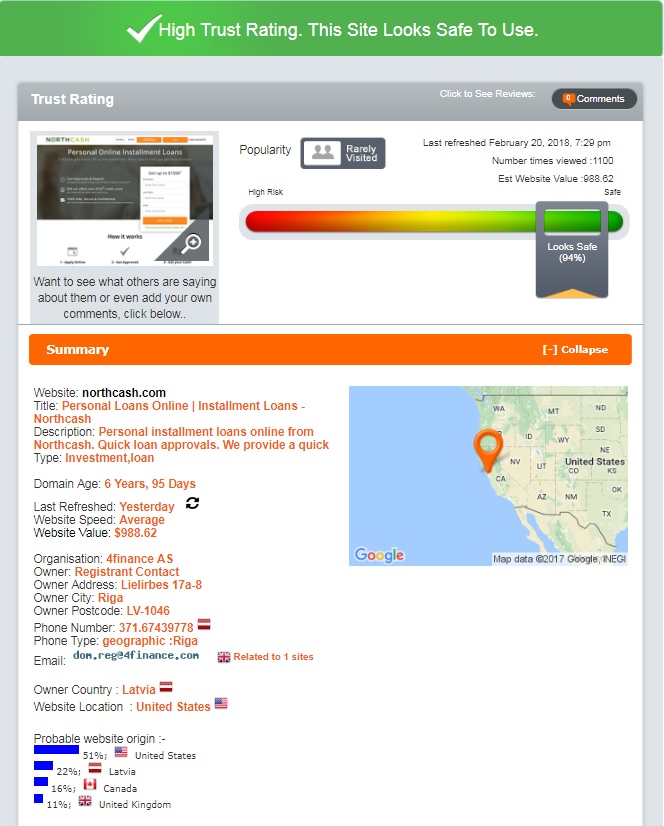

According to ScamAdviser, this lender has a trust rating 94% out of 100% and seems safe to use:

The analysis revealed that the domain was created more than 6 years ago. The site is located in the United States and is owned by Riga, Latvia. In additions, the site may be somehow related to Canada and the United Kingdom. However, it still seems safe and legitimate.

North Cash Reviews

On-site Reviews

Unfortunately, the native website does not have any reviews from customers who previously used this lender. So I could not check the reputation of North Cash. I recommend the website’s owner to create a special section where customers could share their experience with North Cash loans. So I had to look for reviews on other online sources.

Reviews on Third-Party Websites

I found only 4 reviews about this lender: 3 of them were negative and 1 – neutral. BBB gave North Cash 3.18 stars out of 5 stars:

One customer says North Cash helped his when he was in a difficult situation. He advises all people who want to take a loan need to consider the high-sky interest rates and their ability to repay. He says his amount to repay was gastronomically high and at the end, he had to pay twice as much as his initial loan.

The second client gave the lender the lowest rating. He says he used the services of North Cash two times. I had no problems with this lender the first time. The second time he thought his loan was paid in full since he received no emails, no notifications, nothing. Later, he found out he owed $600 to this lender. The customer service was not helpful. They answered they called many times and nobody answered. The client warns everyone that they are thieves working illegally.

The third customers took a loan in the amount of 600. He repaid the loan early but still was charged interest up until the due date specified in the agreement. He thinks it’s a robbery.

One more user was very disappointed at this lender, he says that are THIEFS who make money out of customers’ personal crisis. He asks all people think twice before taking a loan through this website.

Contact Us section

Contact Information

The lender provided the following contact details:

- NorthCash phone number: 1-855-333-6570

- Fax: 1-888-454-2368

- Email: [email protected]

- Mailing Address: North Star Finance, LLC, PO box 498, Hays, MT 59527

This is a comprehensive contact information. I really appreciate that the lender tries to be as transparent as possible.

North Cash Locations

North Cash services are available in the following US states: Alabama, Alaska, Arizona, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Washington, Wisconsin, Wyoming.

Northcash does not lend to people residing in Arkansas, California, Georgia, Maryland, Minnesota, Montana, New York, Pennsylvania, Virginia and West Virginia.

Getting a Consultation

As mentioned on the site, North Cash customer support team is always ready to help. Clients may reach a manager by calling at 1-855-333-6570 or by emailing at [email protected]. The customer care department is available Monday through Friday from 6 a.m. To 7 p.m.

I tried to reach the lender by sending an email. I was interested in where I could get a loan with a bad credit score. Regretfully, I did not receive an answer within the specified period. I think customer service is one of the things that need to be improved.

Conclusion

NorthCash.com is a transparent and legal lender providing quick installment loans online. Using this site, you need to remember that it’s a tribal-owned lender and not subject to suit by the customer or any third-party. The company offers competitive interest rates but limited amounts of money and strict eligibility requirements. The website is very informative and convenient but it’s not enough to rank this lender high. I was really concerned about NorthCash reputation because I found only negative customer reviews on the net. For this reason, I recommend that you weight all pros and cons of this lender before taking any loans through this website. The company deserves 3,3 stars out of 5.

Ready to Apply?

Ready to Apply?