What is Payday Uk?

PaydayUK is an online service committed to responsible lending which offers short-term flexible loans which can help people with a cash boost. The company is registered and operates from the United Kingdom. PaydayUK is a trading name of Instant Cash Loans Ltd. authorized and regulated by the Financial Conduct Authority for credit-related activities. According to the information placed on the website, the company offers payday loans focused on the needs of customers, and treat them in a helpful and courteous manner. They claim to always assess whether a client can afford any loans and can repay them. PaydayUK assures customers they provide transparent customer contracts, maintain high levels of customer satisfaction, and do not target people with debt problems.

PaydayUK is an online service committed to responsible lending which offers short-term flexible loans which can help people with a cash boost. The company is registered and operates from the United Kingdom. PaydayUK is a trading name of Instant Cash Loans Ltd. authorized and regulated by the Financial Conduct Authority for credit-related activities. According to the information placed on the website, the company offers payday loans focused on the needs of customers, and treat them in a helpful and courteous manner. They claim to always assess whether a client can afford any loans and can repay them. PaydayUK assures customers they provide transparent customer contracts, maintain high levels of customer satisfaction, and do not target people with debt problems.

The company is regulated not only by the FCA but is also a member of the Consumer Finance Association (CFA), which means that PaydayUK services comply with responsible lending guidelines. The CFA membership ensures customers are treated fairly. The company is also a CIFAS member, which mission is to detect, deter and prevent fraud.

| Loan types | Min.amount | Max.amount | Period | Daily PR | Documents | Poor credit |

| Payday loans online, installment loans online | £100 | £2000 | 1 month to 1 year | 0.36% – 0.8% | No | Possible |

PaydayUk.co.uk Loan Types

Payday Uk specialty is short-term loans: payday loans and instalment loans.

- A payday loan is typically repaid on the next payday;

- An installment loan requires a fixed number of regular equal payments.

The customers can get acquainted with the full description of these loan types by following the links presented on the website:

Payday Uk informs that of a loan application has been received and completed by 3 pm, the client will get a same day money transfer. For repeat customers, their deposit times run 4 am to midnight, and the money will be cleared into account within 2 hours from the time of deposit, but some banks may take up to 3 working days to transfer the funds.

Terms of Use

In order to apply for a loan from Payday Uk, customers must correspond to the following criteria:

- To at least 18 years old;

- To be employed, receive a pension, disability benefit or living allowance and receive more than £417 per month;

- To have a valid debit card;

- To have a valid email address and phone number.

Customers can be approved for a loan amount between £100 and £2,000 for a period from 1 month to 12 months. Borrowing for a longer period is more expensive. The most popular loan lengths are 1 month loans, 3 month loans, 6 month loans and 12 month loans. Customers should be aware that all loans are subject to lending criteria assessment and a credit history check.

The cost of a loan depends on the amount that a client borrows and how long he would like to repay it. Payday Uk interest is charged at a daily rate an ranges from 0.36% to 0.8%, which means customers will have to pay between 36 to 80 pounds per day per every £100 borrowed.

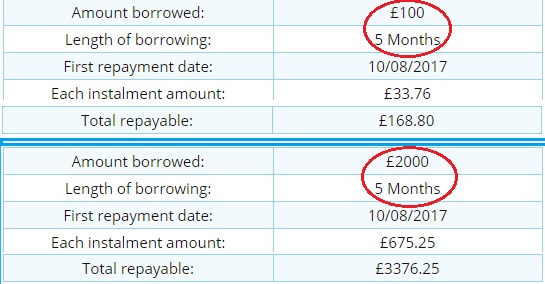

See more examples of how the amount borrowed changes the repayable loan amount:

PaydayUk.co.uk always tells their customers what their APR is before they sign an agreement. The APR can vary depending on such factors as:

- The interest you must pay;

- The loan term;

- The schedule of payments;

- The amount of each payment;

- Certain fees associated with the loan.

The lender claims to have no other fees and no hidden costs.

Application Process on PaydayUk.co.uk

On PaydayUk.co.uk, customers can apply for a short-term loan online by following 3 simple steps:

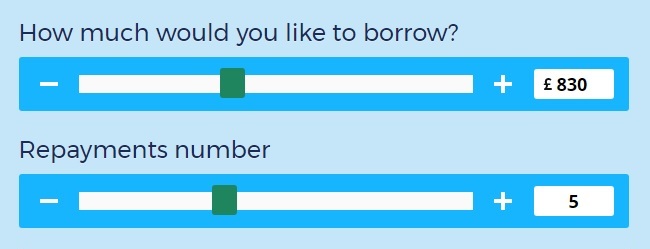

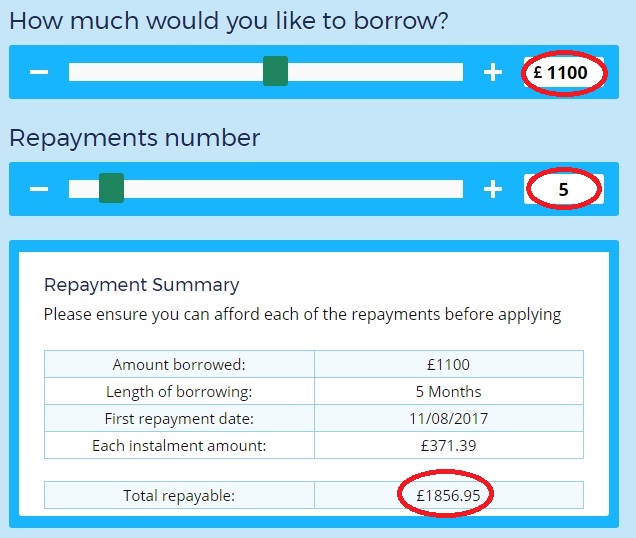

Using the loan calculator, customers should select the loan amount between £100 – £2,000, and choose the repayments (1 to 12 installments):

Once customers selected the required loan amount, they should click «Apply Now» and fill in the application form, where they need to provide the following information:

- Name and address;

- Date of birth;

- Telephone numbers and email;

- Employment and regular income details;

- Monthly expenditure information;

- Bank account and debit card details.

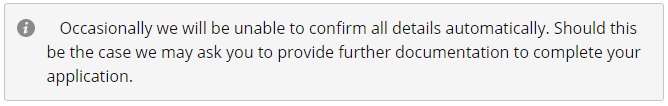

After all these steps completed, customers should submit their application and wait for a decision. PaydayUk requires no documents from the customers and no guarantor. However, the company mentions that in some cases, the clients may be asked to provide some documents for confirmation:

Once the application has been processed, PaydayUk will contact the customer by email.

Loan Repayment

With PaydayUk.co.uk, customers will have to repay their loans between 1 to 12 months. The online lender usually takes payment automatically from a client’s debit card he provided. If applicants no longer have a debit card, they can call PaydayUk customer support service and make alternative payment arrangements.

The main page of the website warns the customers that late repayment can cause them serious money troubles. So, they should be sure they are also to repay a loan on time.

The company also pay attention to the fact that customers can repay their loan early at any time by logging into their online account or calling on 0330 024 1642. Since the company charges interest daily, clients will only pay interest on the number of days they have the loan for.

The users should bear in mind that they can change their repayment date, if necessary. For this, they should call PaydayUk on 0330 024 1642 for discussing payment options as soon as possible, and the lender promises to do his best to help. If a customer does not inform the lender about his inability to pay, PaydayUk will have to report to Credit Reference Agencies which may have a negative effect on his credit.

Loan Extension

The lender understands that a client may have some personal and financial circumstances that prevent him from repaying the loan amount according to the schedule. In this case, PaydayUk.co.uk may meet the customer halfway and reconsider the scheduled payment. However, the users should bear in mind that if there are no more extensions left, PaydayUk will have to sell his debt to a third party company for collection. The user’s account will be owned by PRAC Financial Limited.

PaydayUk.co.uk Bad Credit History

PaydayUk loans are subject to a credit check. They look at each application based on a client’s recent circumstances. If a customer has a very poor credit history and did not respect his previous credits, his loan application can be denied. However, each case is very individual.

Technical Characteristics of the Website

Is PaydayUk.co.uk Safe in Terms of Connection?

Payday Uk guarantees that all transactions on the website are 100% safe and nobody will have access to users’ personal information. We checked this statement: it turned out that the lender uses a 256-bit Secure Sockets Layer (SSL) software on the website, which encrypts all users’ information.

This security level is decent but not the best one. The upper left corner of the browser shows a green lock which indicates that PaydayUk.co.uk is a safe place for taking loans online. The security certificate is verified by Symantec Corporation:

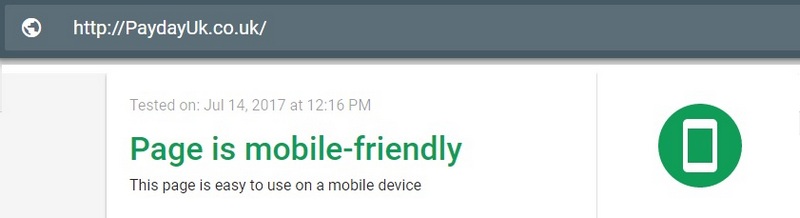

Mobile Version

Google Search Console helped us evaluate the mobile version of PaydayUk.co.uk. The analysis showed that the website is mobile-friendly:

However, the online service determined that not all PaydayUk page resources could be loaded, and the users might have some difficulties when visiting the site from a mobile device. In general, the mobile pages look the same way and have the same functionality. We noticed that text is too small to read and clickable elements are set too close together. We suggest the company should fix these drawbacks and make their website even more mobile-friendly. People want a service which operates fast and functions properly in all respects.

Checking Antivirus

The website uses Qualys SECURE and has the appropriate seal on the main page. This service scan the websites for the presence of malware, network, and web application vulnerabilities:

The Qualys SECURE service allows visitors to use the website without fear of being infected. The service prevents attackers from getting access to the specific information stored on the host. In addition, Qualys SECURE verifies that PaydayUk.co.uk’s SSL certificate is valid and current.

So, we may conclude that the users’ information is completely secure or safe with this online service, which adds the lender more trust.

The Convenience of Using PaydayUk.co.uk

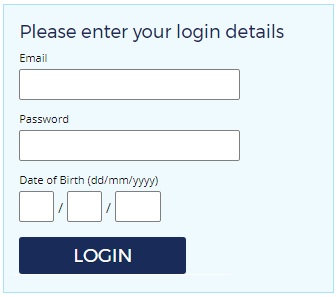

The first aspect which makes Using PaydayUk.co.uk convenient is that customers do not need to register on the website in order to start an application procedure. However, if users plan to use PaydayUk services for more than once, they can create a personal account in order to save their personal information:

As we have already mentioned, The application form is standard and short, and the user requires no guarantor and no documents.

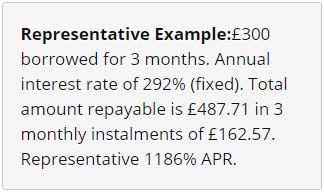

We also appreciate that the lender provided many representative examples of loan terms – they are very helpful. With their help, customers can better understand how PaydayUk works. For example, the table below shows the terms and conditions for a client who borrows 300 pounds for 3 months:

The online lender has made the website even more convenient by providing a convenient PaydayUk calculator which allows borrowers to get a deeper understanding of the company’s terms and rates. The example below shows that if a customer loans 1100 pounds for 5 months, he will have to repay a total amount of 1856.95 pounds:

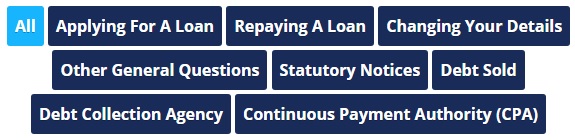

We also like the way Help Centre page (also know as FAQ) organized: all questions are divided into categories and the user can find the necessary information in the shortest term:

Besides, the Help Centre page contains a search bar which is even more helpful:

In general, the website is very informative. We managed to find all information we were interested.

The application form is easy, contains only the necessary information and does not require much time.

Is PaydayUk.co.uk Legit?

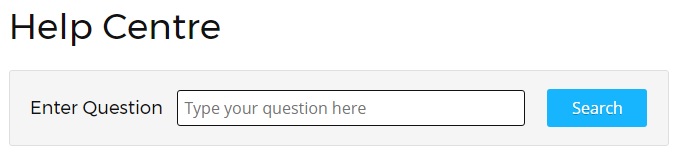

Before people take loans online, they need to know that the website is legitimate and can be trusted. We checked PaydayUk.co.uk credibility using Scam Adviser and the results were far from perfect: the online lender has a 10% trust rating out of 100:

According to Scam Adviser, this website appears to be based in the United Kingdom but somehow relates to the USA. The domain age is more than 13 years, which is a good indicator and a decent period for an online lender. However, the website is rarely visited. Scam Adviser gives a low trust rating to PaydayUk.co.uk since there are bad reviews detected. So, users should review this information carefully before applying for a loan online.

PaydayUk.co.uk Reviews

On-site Payday Uk Reviews

Regretfully, we found no PaydayUk.co.uk reviews on the website itself. There is no section devoted to the users’ experience with this online lender. It’s too bad since before applying for a loan, customers want to know what other people say about this service. We thick user reviews is a necessary part of any lending service online. And it’s no surprise – customer reviews are the best way of checking the reputation of the company. We were not able to assess the credibility of PaydayUk basing on customer on-site reviews, so we had to look for any comments on other websites and forums.

PaydayUk.co.uk Reviews on Independent Websites

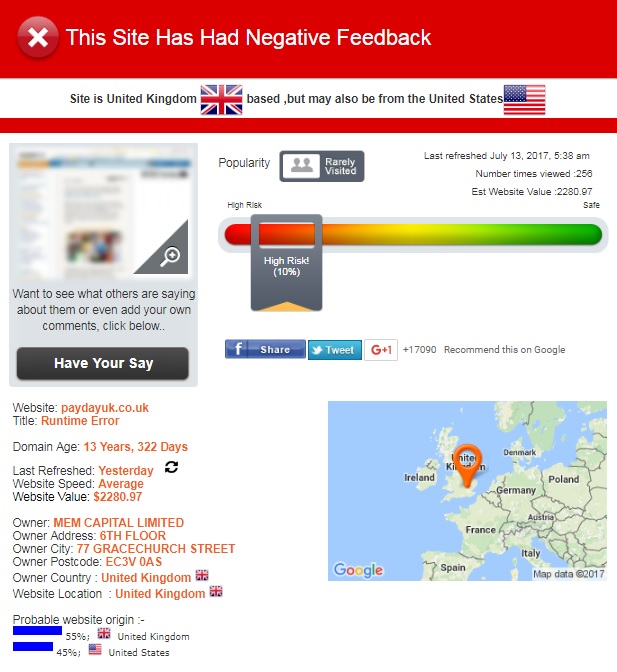

We found a great number of PaydayUk.co.uk reviews on uk.trustpilot.com. It turned out that the lender has 3465 customer reviews with 80% reviews being positive and only 3% being negative. There are many good PaydayUk reviews in 2017. The company has an Excellent trust rating of 9.3 stars out of 10 on Trustpilot.com:

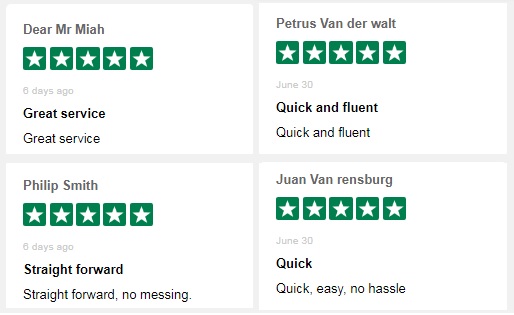

It seems strange that new PaydayUk reviews are being posted on uk.trustpilot.com every day, though ScamAdviser detected the online lender service is not popular. We looked through the comments and found out that almost all users are happy with the services provided, very fast response and money transfer, reasonable interest rates, and excellent customer support. Some reviews have a feedback from PaydayUk representative. Look at some screen below to see what people think about this lender:

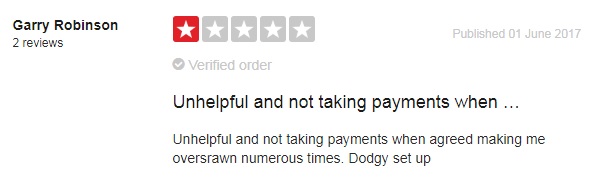

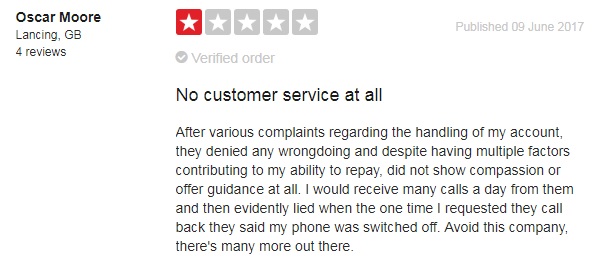

Customers who rated the company 1 or 2 stars complained of a horrible customer service. However, all of the unhappy uses had some problems with loan repayment. The comments seem to be written by real customers:

Read all PaydayUk reviews: https://uk.trustpilot.com/review/www.paydayuk.co.uk

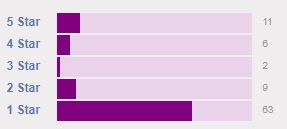

Regretfully, reviewcentre.com showed the lender in a new light: the website contained more than 91 customer reviews, and 72 of them were negative:

Most users were unsatisfied with the lender as they wasted their time on waiting for a loan approval, though it was advertised on the website that the loans are approved within 1-2 hours. Some of the users never received their money.

All PaydayUk reviews 2017 were frustrating. You can read all of them here: http://www.reviewcentre.com/reviews253566.html#Reviews.

Though the lender has numerous present-day comments, they are controversial, and we cannot be too sure about trying out this online lender.

Contact Us section

Contact Information

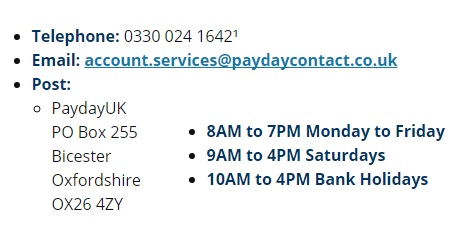

Payday Uk provided the following contact information on the website: phone number, email, mailing address, the hours of operation:

However, we found no legal address of the company. The year of the foundation was not also specified. And this information is very relevant for users.

Locations

Customer Support Service

Unfortunately, the website has no Live Chat where we can learn the necessary information as soon as possible. If customers cannot find the answer to their questions in Payday Uk, they can send an email at [email protected] or call at 0330 024 1642. The lender guarantees that the customer service representatives will answer all questions in the shortest time. According to the information placed on the website, unsatisfied customers can contact the Customer Relations Department which will try to resolve all concerns immediately.

We decided to check the quality of the lender’s customer support service and sent them an email asking to specify Payday Uk year of foundation. It does not seem that the company is “available 24 hours a day, 365 days a year”, as we waited for an answer several hours but received no feedback. PaydayUk customer support needs to be more speedy. Otherwise, clients will simply find another online lender with an instant messaging.

Conclusion

Using PaydayUk.co.uk is an online service that has numerous benefits: flexible repayment options, a same day money transfer (though we were not able to check this), minimum documentation and paperwork required. FCA and CIFAS membership also testify for PaydayUk reliability.

ScamAdviser, however, was skeptical about the lender’s location and awarded the company only a 10% trust rating out of 100%. This was the first red flag. The lender has received mixed reviews from its customers so we can’t be for sure about its working. Even if the service had thousands of positive comments posted on Trust Pilot UK, we are still double-minded regarding the integrity of these testimonials. These feedbacks were only found on one website and they seemed unnatural which means that they could be compromised and may not be 100% reliable. Of course, PaydayUk.co.uk would not be among our top priorities for taking payday loans online.

Ready to Apply?

Ready to Apply?